Kahnattorneys.com – DSCR loan vs conventional loan is certainly an interesting topic. How could it not? Both of these loans can be used to finance a real estate investment. However, they are not the same. They offer different things, which makes them an ideal financing strategy for one investor but not for another.

In this post, we explain several things that make them different. We start with the pros and cons of both types of loans. After that, we explain their debt-to-income requirement, interest rates, which one is easier to qualify, down payment, loan amount, repayment terms, and approval process.

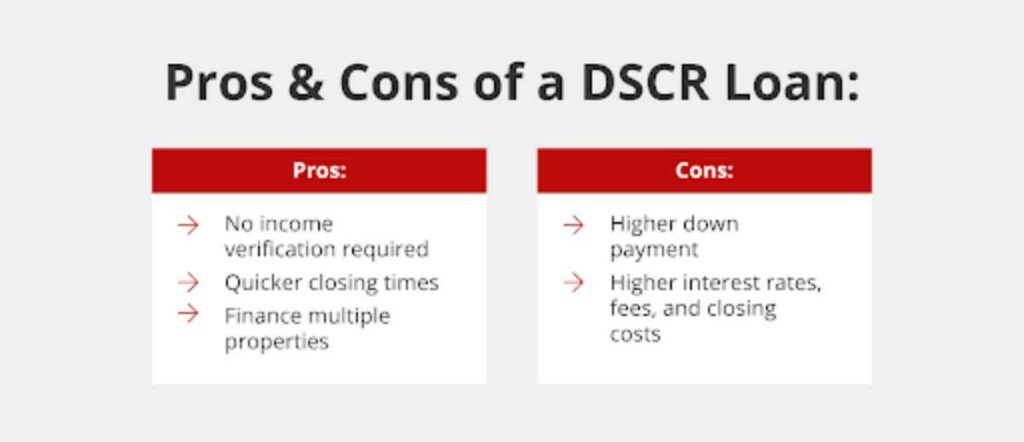

Pros and Cons of DSCR Loans

Pros

- No income verification required

- Faster closing times

- Finance multiple properties

Cons

- Higher down payment

- High interest rates, fees, and closing costs

Pros and Cons of Conventional Loans

Pros

- Choose from several types of mortgages

- Lower down payment

- Relatively low interest rate

Cons

- Can be difficult to qualify fpr

Debt-to-Income Requirement

When you are looking forward to getting a loan, one of the first things to consider is the debt-to-income (DTI) ratio. Of course, this applies to DSCR loan vs conventional loan as well.

DSCR loans don’t have DTI restrictions. As such, borrowers won’t need to worry about having a high DTI ratio and not being approved for the loan. They can secure a loan even if their DTI is too high for a conventional loan.

Conventional loans, on the other hand, have a DTI requirement of 45%. If the DTI of a borrower is greater than 45%, they will not qualify for the loan.

Also Read:

- DSCR Loans Colorado: Debt Service Coverage Ration Loans

- DSCR Loans Hawaii: Debt Service Coverage Ratio Loans

- DSCR Loans Michigan: Debt Service Coverage Ratio Loans

Interest Rates

It is also crucial to understand each loan’s interest rates. These are the money a lender will charge the borrower for borrowing funds. The lower the rate is, the better. In terms of interest rates, conventional loans are the winner.

Conventional loans often come with lower interest rates than other types of financing. In addition, the lender doesn’t have to pay for guarantee fees or government insurance, which helps to lower the costs.

DSCR loans in general have higher interest rates than conventional loans. With DSCR loans, lenders are facing greater risk. That is why they charge higher interest rates.

Easier to Qualify

DSCR loan vs conventional loan, which is easier to qualify for? Between the two types of loans, DSCR loans are easier to qualify for. Due to this, DSCR loans are the better option for real estate investors who have a short history in the industry and/or limited financial resources.

DSCR loans consider rental of the property income, which is why they are more accessible for real estate investors to qualify for. Conventional ones are not as easy to qualify for.

They usually have stricter qualifications than other financing options. For example, to qualify for a conventional loan, a borrower must have a stable income, strong credit, and a solid DTI ratio.

Down Payment

A down payment is the amount of money a borrower must pay upfront when taking out a loan. The larger the down payment of a loan, the lesser the monthly payments will be. Conversely, the lower the down payment of a loan, the greater the monthly payments will be.

If we compare DSCR loan vs conventional loan, conventional loans tend to have a lower down payment than DSCR loans. The minimum down payment of conventional loans is between 5% and 20%.

Since DSCR loans have a higher down payment, they are less attractive for borrowers who have limited funds for a down payment.

Loan Amount

Loan amount is the amount of money borrowed from a lender for a specific purpose. In the case of DSCR loan vs conventional loan, the specific purpose is a real estate investment. So, the loan amount includes the purchase price of a property and closing costs.

DSCR loans are usually based on the rental income of a property. The loan amount of a DSCR loan is determined by how much money the property can generate in rent. On the other hand, the loan amount of conventional loans is usually based on the value of the property.

Repayment Term

The repayment term dictates how and when a loan must be repaid. It includes the interest rate that the borrower must pay as well as other associated costs. When it comes to the repayment term, DSCR loans tend to be more flexible than conventional loans.

For example, a borrower can select adjustable- or fixed-rate mortgages and other loan structures and repayment options. Conventional loans are stricter in general. They often require a monthly payment that cannot be changed.

If you want a loan with a more flexible payment term, a DSCR loan will be the better option.

Approval Process

Last but not least, the approval process. This process helps ensure that all involved parties regarding the loan have reviewed and agreed to a decision prior to its completion, reduce errors, and ensure compliance with company procedures and policies.

DSCR loans often require fewer verifications than conventional loans. Lenders only need to verify the cash flow of the property. As a result, the approval process for DSCR loans tends to be faster than that of conventional loans. Conventional loans have a longer approval process, which makes the closing longer.

DSCR Loan vs Conventional Loan: Which One Is Better for You?

Each loan type comes with pros and cons. DSCR loans, for example, offer faster closing times and the ability to finance multiple properties, No income verification is required, too.

On the other hand, DSCR loans typically come with a higher down payment, high interest rates, fees, and closing costs.

With conventional loans, you can choose from several types of mortgages. They also come with lower down payments and relatively low interest rates. Conventional loans, however, can be difficult to qualify.

So, which loan is better for you? The answer depends on your unique needs. Either loan can finance a real estate investment.

That’s DSCR loan vs conventional loan in brief. DSCR loans are great for real estate investors who want to separate their personal and business finances. Conventional loans will work well for many investors, especially those who want to leverage their personal finance to break into real estate investing.