There is a buzz going around the Cup Loan program. Many online websites are talking about it. It is said that the program offers an attractive loan for people who are in need of quick money. What are Cup Loan requirements? How to apply and qualify for it? Also, what are the benefits of the loan?

In this post, we will answer these questions. By the end of it, you will know what the Cup Loan program is about. Ready? Let’s start right away.

What Is a Cup Loan Program?

Not much detail is known about the Cup Loan program. It is said that the program is a financing solution provided by the United States Department of Agriculture. The purpose of the program is to improve the rural population’s quality and is said to be available in almost every state across the country.

The program is used to empower public facilities such as schools, hospitals, libraries, community centers, as well as fire stations. Through the program, public facilities can gain access to low-interest loans that can be used to improve facilities and services.

From upgrading classrooms in schools and improving libraries to the betterment of medical equipment and recreational spaces. The program addresses different and diverse needs.

Cup Loan Requirements

To get a loan from a lender, a borrower must meet the requirements that the lender has set for the loan. The Cup Loan is no different. There are requirements that you must meet if you want to borrow.

Eligibility criteria

Cup Loan program requirements are simple. Here are the eligibility criteria

- Age 18 or above

- Have a stable source of income

- Credit history and debt-to-income ratio

- Proof of residence

Documentation

As for the documentation, the following will be required

- Identification documents

- Driving license or valid passport

- Proof of income

- Bank statements

What Makes It Different from Traditional Loans?

You might be wondering what makes the Cup Loan different from traditional loans. A lot of things are said about the program. For examples,

1. Easy and quick application

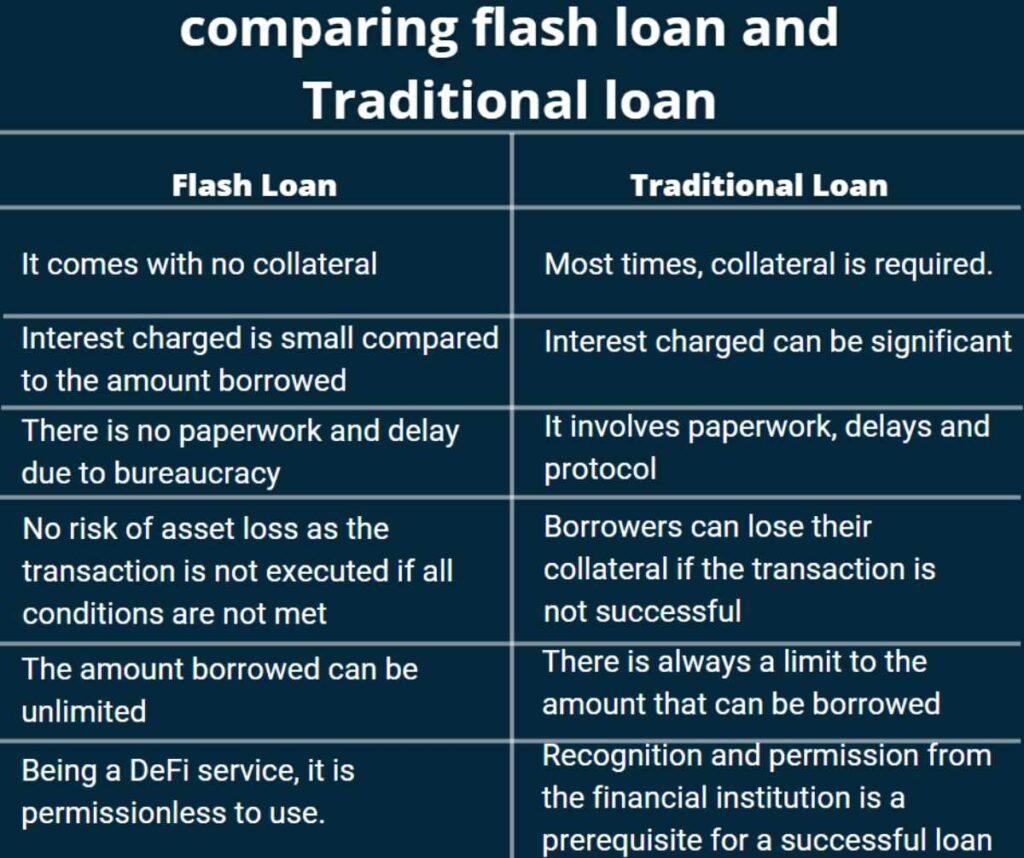

Unlike traditional loans, the program does not require in-person visits and lengthy paperwork. Indeed, the application can be done online.

2. Fast approval process

Regardless of the type of loan a borrower is taking out, there will be an approval process. The process can be quick and easy. It can also be long and daunting. Many say the program has a fast approval process.

3. No collateral

Collateral is often required when taking out a loan. Of course, not all loans require it. Collateral is not a requirement for the program.

The Benefits of the Cup Loan Program

The benefits of the Cup Loan are talked about. Borrowers are said to get the following

1. Flexible repayment terms

When you are looking for a loan, one of the first things to consider is the repayment term. That is, how and when the loan will be repaid. You’d want to have a flexible repayment term that aligns with your financial capabilities.

Getting a loan with a flexible repayment term can mean less burdensome monthly installments. If a borrower can meet Cup Loan requirements, this is one of the benefits they are said to get.

2. Competitive interest rates

There are also interest rates. For borrowers, the lower the interest rate of a loan, the better deal it is. Of course, not all loan offers come with competitive interest rates.

The Cup Loan program, however, is said to come with competitive interest rates that help borrowers achieve their financial goals without financial strain from high interest loans.

3. Streamlined application process

Regardless of the type of loan, borrowers will need to go through an application process. The Cup Loan program is no exception.

What makes it different is that the program is said to have a streamlined application process. Meaning, it is made easy so borrowers can get the money they require easily and quickly. That is, if borrowers can meet Cup Loan requirements.

4. Tailored loan options

People are taking out loans for various reasons. The best kinds of loans are the ones that meet your specific needs. The Cup Loan program is said to recognize each borrower’s unique needs. As such, it provides tailored loan options for borrowers.

Is It Legit?

Considering how many scams are out there, this is a valid question. When it comes to getting a loan, you need to be cautious. Especially so if the loan is too good to be true. Reading the loan’s terms and conditions thoroughly is a must, so you know what to expect and do regarding the loan.

In addition, you should take a look at the loan lender company. Find out if it is a reputable company with a good track record.

These are the Cup Loan requirements. Meeting the requirements is not difficult, which is why it is unsurprising to find a buzz going around the program. The loan offer is also attractive and is said to bring various benefits to the borrowers.

Also Read:

- List of Fake Loan Companies

- What is a Business Purpose Loans?

- How Many Pre-Settlement Loans Can I Get?