Kahnattorneys.com – There are many loan lending companies out there. While this gives you plenty of options, you should know that not all loan companies are legitimate and real loan lenders. A lot of them are fake. You need to be cautious. To help you avoid getting scammed, we have a list of fake loan companies.

We not only list 70+ companies, but we also tell you signs of a fake loan company, how fake loan apps work, and what you can do to protect yourself.

Signs of a Fake Loan Company

If you are not careful when looking for a company to get a loan from, you might lose sensitive information and/or money. The consequences can be dire, as there is the risk of identity theft and fraudulent transactions. Checking out a list of fake loan companies is certainly helpful. But is there any other thing to check? Yes. Fake loan companies have signs, such as

1. The company guarantees approval

Lending money involves risks. Lenders may not get their money back. That is why not all individuals who apply for a loan are approved. Reputable lenders will be interested in creditworthiness. Most importantly, they won’t offer guarantee of approval.

Fake loan companies, however, are not interested. If anything, they tend to seek high-risk borrowers and guarantee approval.

Note that some reputable lenders do offer loans for individuals with bad credit. These lenders will consider more information than credit score, which includes income, educational background, and employment information before approving a loan.

2. The company isn’t registered

If you want to get a loan, make sure that the loan lending company is registered in your state. If the company isn’t registered, steer clear of it. You want to deal with a reputable company, not a shady one.

3. The company demands payment upfront

Some fake companies have been known to demand payment upfront as a pre-requisite to the loan. These companies usually require prepaid debit cards or banking information, claiming that they need the information for collateral or insurance.

Any upfront fee to receive a loan is a big red flag. Legitimate loan lending companies don’t do that. Legitimate companies may charge a payment, but it will be deducted from the loan and not in the form of an upfront fee.

4. The company has no physical address

Another sign to walk away is if there is no physical address. When you want to get a loan, you want to get it from a company that provides a physical location. If you are interested in a loan lending company but it does not provide a physical address, it is better to walk away.

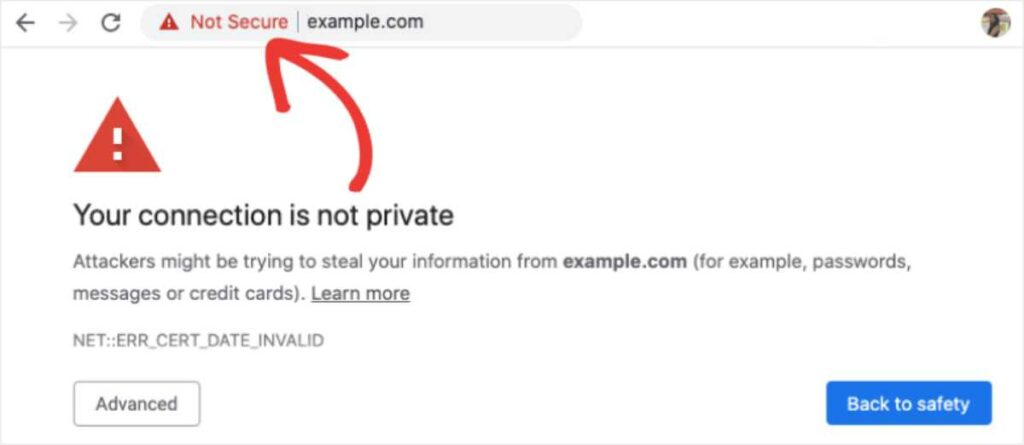

5. The company’s website is not secure

The company’s website should start with “https” with a padlock icon next to it. Legitimate loan companies will have a secure website.

6. If the loan offer sounds too good to be true, it probably is

If the offer sounds like a scam, it probably is. Legitimate loan lending companies won’t offer an irresistible loan offer with a very low rate and guarantee lightning-fast approval.

How Fake Loan Apps Work

Before we get to our list of fake loan companies, you may want to understand how exactly fake finance companies work. They typically work in these ways

1. Personal and financial information theft

Fake loan companies often request personal and financial information such as Social Security numbers, bank account numbers, and credit card numbers. This sensitive information can be used for identity theft or fraudulent transactions.

2. Upfront fee scams

Fake loan companies may also require users to pay upfront fees as a pre-requisite to receive a loan. Once the user pays the fee, the loan is not provided, leaving the user with nothing.

List of Fake Loan Companies

Here is a list of companies to stay away from

- Easy Loan

- Online Loan

- Money Loan

- Personal Loan

- Cash Advance Loan

- Credit Loan

- Instant Loan

- Quick Loan

- Fast Loan

- Same Day Loan

- Urgent Loan

- Fast Cash

- Agile Loan

- Cash Express

- Cash Flow

- Cash Guru

- Cash Junction

- Cash Cube

- Cash Bucket

- Cash Mine

- Cash Point

- Cash Secret

- Cash Shop

- Cash Smart

- Cash University

- Cash Vault

- Cash Voyage

- Cash Volcano

- Cash world

- Cash App

- Credit Bucket

- Credit Basket

- Credit Cube

- Easy Credit Loan

- Bright Cash

- Lucky Wallet

- Cash Hole

- Cash Park

- Clear Loan

- Just Money

- Credit Wallet

- Crystal Loan

- Daily Loan

- Lend Mail

- Discover Loan

- Dream Loan

- Loan Dream

- Early Credit

- Credit King

- Credit Ninja

- Marvel Cash

- May Loan

- Simple Loan

- More Cash

- More Loan

- Silver Pocket

- Orange Loan

- Plump Wallet

- Quality Cash

- Yes Cash

- Loan Tap

- Quick Cash

- Rich Cash

- Magic Money

- Lend Mall

- Cash Station

- Cash Papa

- Cash Magic

- Gold Cash

- Credit Paradise

- Credit Palace

- Credit Master

Keep in mind that the list of fake loan companies above is by no means exhaustive. There may be other fake loan companies that are not included. That is why it is important to stay cautious and avoid any loan companies that seem suspicious.

Also Read:

- Cup Loan Requirements: Your Guide to Qualification

- What is a Business Purpose Loans?

What You Can Do to Protect Yourself

Do your research

First and foremost, do your research. You should do this before applying for a loan from any company. Find out about the company thoroughly. Make sure that it is a legitimate finance company. Check its online reviews, go to its website, and, contact the company directly to ask questions.

Stay away from loan lending companies that ask for upfront fees

No legitimate loan lending companies will ask for upfront fees as a pre-requisite to a loan. If you find a company that asks for an upfront fee before you receive a loan, steer clear of it.

Always protect your personal and financial information

Loan apps will ask for personal and financial information. Make sure that you only share information that is absolutely necessary. Never share sensitive information such as Social Security numbers, bank account numbers, or credit card numbers with a suspicious app.

Our list of fake loan companies above should help you be more careful. The consequences of registering with a fake loan company can be dire, so it is always a good idea to be cautious and skeptical, especially if what the company offers is too good to be true.