When it comes to numbers, Wells Fargo does not offer a lot of credit cards compared to its competitors. However, the credit cards that it does offer are among the best on the market. Unsurprisingly, all of its credit cards require a good credit score. So, how much is the Wells Fargo credit card score needed?

The credit score needed varies from one credit card to another. In this post, we explain five of Wells Fargo’s cards. Namely, Cash Wise, Propel, Rewards, Students, and Secured.

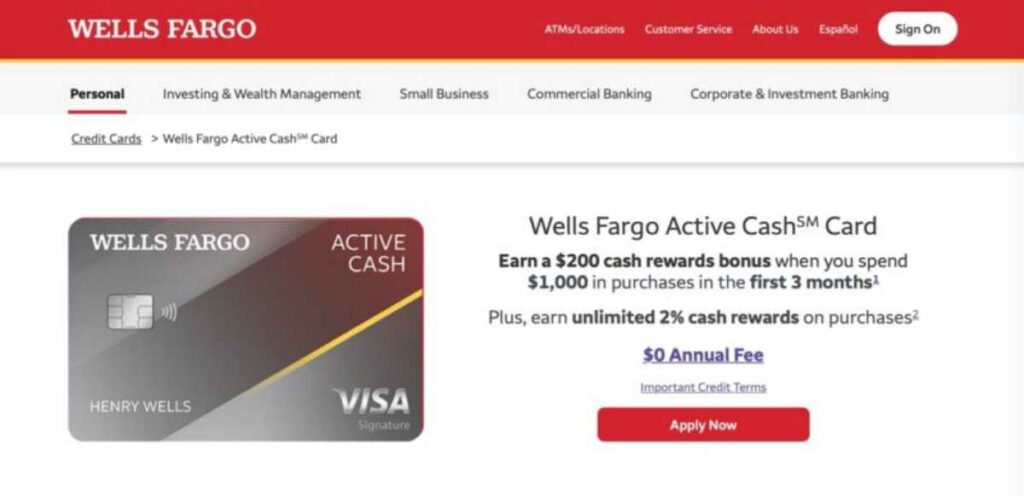

Wells Fargo Cash Wise Visa

The Wise Visa card is a popular choice. It offers consumers simple rewards but doesn’t require much hassle. The credit card offers an unlimited 1.5% cash back on every purchase without categories to track or activate. Its annual fee never changes as well.

To qualify for a Wise Visa card, the Wells Fargo credit card score needed is 700 or higher. Some reviewers report the needed score is between 600 and 700. If your credit score is below 600, the chance of approval is slim to none.

Also, with the right qualifications, you may be able to get starting limits of $15,000 to $25,000. The starting limit for the Wise Visa card is $1,000.

Wells Fargo Credit Card Score Needed for Propel American Express

The next Wells Fargo credit card is the Propel American Express card. The card is a popular choice among consumers who like to earn points on their purchases. With the Propel American Express card, cardholders can earn 3x points per dollar on their travel purchases.

New cardholders are offered some additional perks, including an introductory APR offer and a solid signup bonus, among other things. All Propel American Express cardholders can benefit from paying their cellphone bill with the card as it can unlock up to $600 in cellphone protection.

To qualify for the Propel American Express Card, the Wells Fargo credit card score needed is 700 or higher. Some reviews report that the credit score needed is in the mid-600s.

Regardless, the higher your credit score is, the better the credit limit you will get. The minimum limit you will receive upon approval is $1,500.

Wells Fargo Rewards

Not all Wells Fargo credit cards require a high credit score. The Rewards card, for example, has a relatively low credit score requirement. To qualify for the card, you will need a credit score of at least 630. If you have a credit score of over 700, the approval process will be a lot easier.

The card offers an introductory 0% APR for 15 months on new balance transfers and purchases. In addition, you can earn 5x points per $1 on grocery purchases, gas, and drugstores for the first 6 months and 1x point per dollar on everything else.

What makes the card particularly interesting is that, even with mid-600 credit scores, you may be able to get a five-figure credit limit. As a comparison, the starting credit limit is $1,000 when you are approved.

Wells Fargo Cash Back College

What credit score you need for Wells Fargo credit card Cash Back College? The Cash Back College card is unlike the previous credit cards. It doesn’t require any credit score.

The card, however, is limited only to college students. If you are a college student with little to no credit history, you can apply for the card. Poor negative history, however, may disqualify you.

What makes it enticing is despite being a student card, it comes with some decent perks with a $0 annual fee. Cardholders can earn an unlimited 1% cash back on every purchase, and 3% cash back on up to $2,500 in grocery store, gas station, and drugstore purchases during the first six months.

The Cash Back College card also offers an introductory 0% APR on both new balance transfers and purchases. This perk is quite uncommon for student credit cards. The credit card limit starts from $500.

Wells Fargo Secured Credit Card

Similar to the Cash Back College card, there is no credit score needed to apply for the Secured card. If anything, the Secured credit card is quite similar to a typical secured card in the market.

It requires a cash deposit to open and maintain the account. The credit card limit is determined based on the deposit you make at a 1:1 ratio. The minimum deposit requirement is $300. The annual fee is $25, and it can be upgraded to an unsecured account.

What makes the Secured card worth checking out is that it can be used anywhere Visa credit cards are accepted. It is an excellent card for building/rebuilding credit. Plus, it has the standard set of Wells Fargo benefits, which includes cellphone protection among other things.

So, how much Wells Fargo credit card score needed? That depends on the card. The Cash Back College and Secured cards, for example, don’t require any credit score. Meanwhile, the Wise Visa and Propel American Express cards require a high credit score, but they do come with more benefits.

Also Read:

- Credit Card Vault: What is it, Fundamentals, and Advantages

- Credit Card Stacking: What is it and How to Use it?