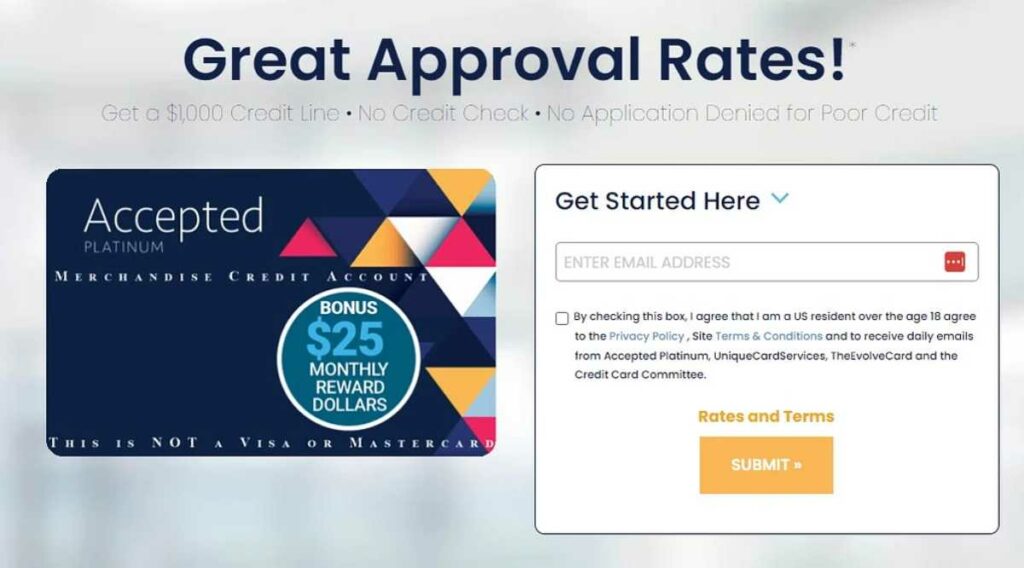

The Accepted Platinum credit card has been gaining popularity recently. This is hardly surprising. After all, the credit card offers enticing rewards and has no annual fee. It is a good starter credit card as well. The question is, is the card the right choice for you?

We can help you answer these questions. In this post, we explain the pros and cons of the credit card, several things to consider, how to apply, and some frequently asked questions about the card.

Card Overview

The Accepted Platinum card is a visa signature card issued by the First Digital Bank. The credit card offers

- 1.5% cash back on all purchases

- 0% APR on balance transfers and purchases for the first 12 months

- No annual free

- No foreign transaction fees

At a glance, the rewards and intro APR the credit card offers make it appealing. That said, it is better to know its pros and cons before deciding if it is the right choice for you.

Pros of the Accepted Platinum Credit Card

Solid cash back earning rate

Accepted Platinum credit card rewards include 1.5% cash back on all purchases. This is a strong cash back earning rate, especially for a credit card with no annual fee. Moreover, it adds up quickly, which allows you to earn hundreds of dollars back every year.

Generous 0% intro APR

In addition to a solid cash back earning rate, the Accepted Platinum credit card also offers a 0% intro APR offer. The 0% intro APR applies to balance transfers and purchases for the first 12 months.

This means you will have over a year to pay off large purchases or transferred balances without accumulating interest in the process. Just make sure that you pay your balance in full before the intro period ends.

No annual fee

If you are concerned about the annual fee, the credit card Accepted Platinum offers is worth checking out. As the card has no annual fee, you have one less expense to worry about every year. It is a nice feature.

No foreign transaction fees

If you often travel abroad, this perk will be useful for you. The card has no foreign transaction fees. Thus, saving you 3% on international purchases.

Cons of the Accepted Platinum Credit Card

High APR after the intro period

During the first 12 months, the intro APR is 0%. But after the period ends, the regular APR is 29.99%, which is quite high. As a result, carrying a balance becomes quite expensive. You will want to pay off your purchases in full each month.

Limited benefits

Accepted Platinum credit card does offer an attractive cash back. The card, however, only has a few other benefits. It doesn’t give rental car coverage, travel insurance, or other premium perks that competitors offer.

1.5% cash back isn’t that high

1.5% cash back is quite a solid rate for a card with no annual fee. When compared to competitors, the rate isn’t that high. Some other cards with no annual fee offer 2% cash back.

Reports as a secured credit card

The card may report to the credit bureaus as a secured card. As a result, the card may not help build credit history as effectively as an unsecured card.

Is It the Right Choice for You?

Now you know the rewards and limitations of the credit card. The question is, is the card a good fit for you? That depends. It is the right choice if

- You want to earn a flat 1.5% cash back rate without paying an annual fee

- You will take advantage of the 0% intro APR offer on balance transfers and purchases

- You don’t need shopping benefits or premium travel insurance from a credit card

- You need to build up your credit score and have a limited credit history

However, if you have excellent credit and/or want to maximize rewards from a credit card, the Accepted Platinum credit card may not be the right choice for you. Still, it is a decent starter credit card if you are working on building credit.

Also Read:

- What is Ledger Green Credit Card Charge?

- Wells Fargo Credit Card Score Needed

- Sprint Credit Card: Everything You Need to Know

Accepted Platinum Credit Card Requirements

- 18 years old and above

- US resident

- Checking account, debit or credit card

- Bankruptcy must be discharged

These are the only requirements to apply for the credit card. When you apply, the Accepted Platinum doesn’t perform any hard inquiry. A checking account, debit, or credit card is necessary because it will be used to pay the monthly membership fee of the card.

As for bankruptcy, you must be discharged from bankruptcy if you have filed for one. If you are in the middle of a bankruptcy filing and proceeding, you will not be accepted. Having a past bankruptcy won’t affect your application as long as you have been discharged from it.

How to Apply

The application process is easy and quick if you can meet the requirements. Here are the steps

- Go to Accepted Platinum’s website.

- Enter your email in the Get Started Here box.

- Provide your personal information (name, date of birth, address, etc.)

- Read and review the terms and conditions.

- Submit.

You will be notified if you are approved. When your Accepted Platinum credit card arrives in the mail, you can use it right away.

Frequently Asked Questions

Is there a sign-up bonus for new members?

At the moment, unfortunately, no. The main reward you will get is 1.5% cash back.

Can the card be used internationally?

Yes, it can. What’s more, the credit card has no foreign transaction fees. So while you travel abroad and shop, you won’t need to worry about such fees.

What credit score is required to qualify?

We don’t know. Accepted Platinum does not post the minimum credit score requirement. The card is, however, intended for those who are new to credit or trying to build/rebuild their credit.

Is there an app for the card?

No. While there is no mobile app to manage the credit card, you can access your account online and manage your credit card through Accepted Platinum’s website.

Accepted Platinum credit card offers various rewards. It is definitely worth checking out if you want a credit card with no annual fee. It is a good starter card, too. It does have limitations, however. The APR rate is high after the intro period ends and it doesn’t have as many offers as its competitors.

https://www.youtube.com/watch?v=xdnDpURujmc&pp=ygUdYWNjZXB0ZWQgcGxhdGludW0gY3JlZGl0IGNhcmQ%3D