While customer data is useful in many ways to merchants, they have the responsibility to protect it. This is not an easy task. Not to mention the risk of a security breach is always present. The good news is, merchants can use a credit card vault to securely store their customers’ sensitive data.

In this post, we explain what a vault is, the benefits of using a third-party vault, and how to choose the right vault for your unique needs.

What Is a Credit Card Vault?

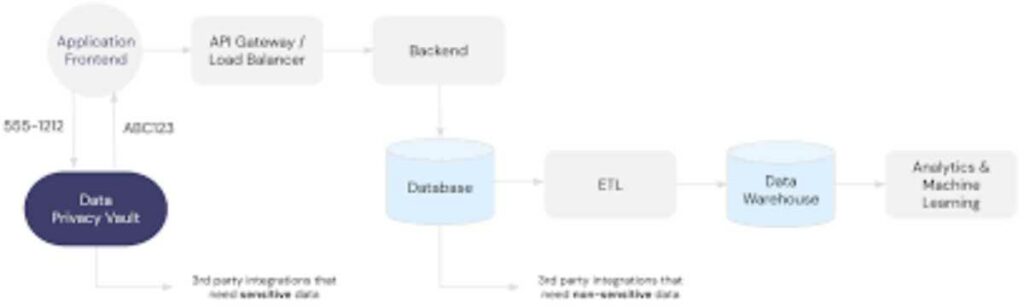

To put it simply, it is a place on which card credit details are securely stored. Vaults commonly use tokenization to safely store data. The process involves turning card credit data into a series of randomly generated numbers known as a token. A token can be used to identify the original card credit data.

Using a vault means when a merchant receives a card number from a customer, the sensitive data doesn’t enter their device, computer, or network. In addition, the vault’s software stores the data in secure servers and creates a protective barrier between your equipment and financial data.

By turning cardholder data and card details into tokens, they become indecipherable to hackers or fraudsters in the case of a security breach. Since tokens cannot be used outside of the vault, the data stored is unassailable.

Benefits of Using a Third-party Credit Card Vault

1. PCI DSS compliance

One of the most important benefits of using credit card vault services is PCI DSS compliance. When you store or process credit card data yourself, you are liable for PCI DSS compliance. Here’s the thing: becoming PCI-compliant can be a difficult and laborious process.

Not only does it require a lot of hours from your team but it also requires certification, which typically comes with a hefty price. For large businesses, the price tag can be somewhere between $50,000 and $200,000.

Furthermore, if you fail to comply multiple times, it can result in you losing your right to process card transactions. If you are using a third-party credit card vault, it will help reduce your PCI DSS scope.

2. Vaults handle sensitive customer data securely

Data breaches can result in fines of up to $500,000. It is hardly a surprise if merchants are concerned with how to handle sensitive card details securely.

Besides fines, the public perception of merchants who have had a security breach is very negative. This, in turn, can have a significant impact on customer loyalty. A credit card vault is an effective method of handling sensitive data securely, helping prevent merchants from security breaches.

3. Vaults reduce payment friction

For customers, having to enter card data often can be annoying. For merchants, it can be a barrier to checkout. A credit card vault can reduce payment friction. With a vault, customers won’t need to enter their card data often as it is kept securely. For the merchants, it reduces payment friction.

4. Seamless subscription management

For merchants who engage in subscription-based, streaming platforms, and record services, storing customer data securely is necessary. When taking monthly payments, any payment failures or frictions can result in customers deciding to cancel their subscriptions.

With vaults, merchants no longer need to worry about subscription management. Vaults not only facilitate monthly subscriptions but also help prevent any failed transactions.

5. Vaults enable global expansion

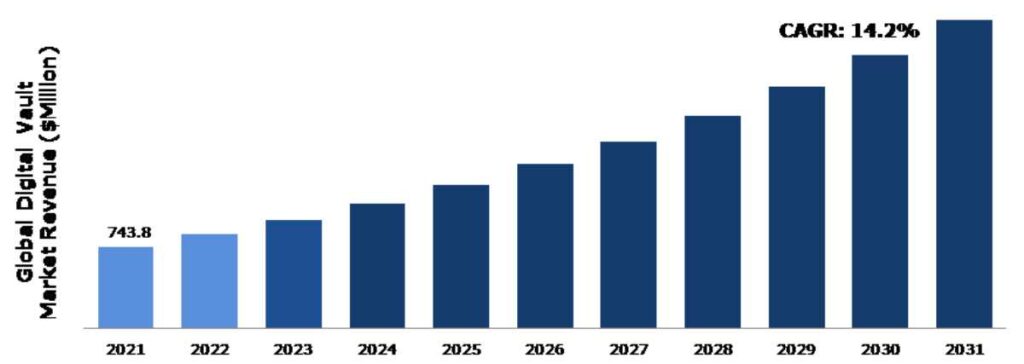

A credit card vault facilitates a more accessible payment ecosystem, allowing merchants to be able to access a wider range of payment gateways. These include payment gateways in regions where a merchant may not currently operate.

Vaulting connects merchants with the right combination of payment service providers required d to support their unique needs. As a result, merchants can scale their business faster.

Also Read:

- Sprint Credit Card: Everything You Need to Know

- Credit Card Stacking: What is it and How to Use it?

How to Choose a Vault

There are lots of credit card vault providers out there. How do you choose the right one? First and foremost, you need a provider that meets the basic PCI compliance requirement. This is necessary because you want to be as PCI-compliant as you possibly can.

Secondly, you need to check out the integration. There are two sides to a vault’s integration: the front end and the back end. For the front end, you want it to be easy to customize so you can tailor it to match your brand. For the back end, it should be simple and well-documented.

Thirdly, uptime. Uptime is also important. There are no hard rules when it comes to uptime. Remember, everyone has bad days. The best thing you can do is to aim for 99.99% of availability.

Fourthly, the migration process. You want to make sure that your vault provider allows exports. This is to ensure that you can move data seamlessly whenever you need to do so, which you probably will need at a certain point.

A credit card vault can help merchants secure their customers’ sensitive data. In addition, a vault enables merchants to improve the buying experience for their customers, make seamless subscription management, and scale their business, among other things.