There are various types of investment strategies. Understanding what those strategies are is necessary before making any investment. The problem is that understanding them can be overwhelming, especially for beginner investors. In this post, we tell you everything you need to know about deep value investing.

We explain the definition, whether the investment strategy is right for you, how to identify deep value stocks, some challenges for deep value investors, and others.

What Is Deep Value Investing?

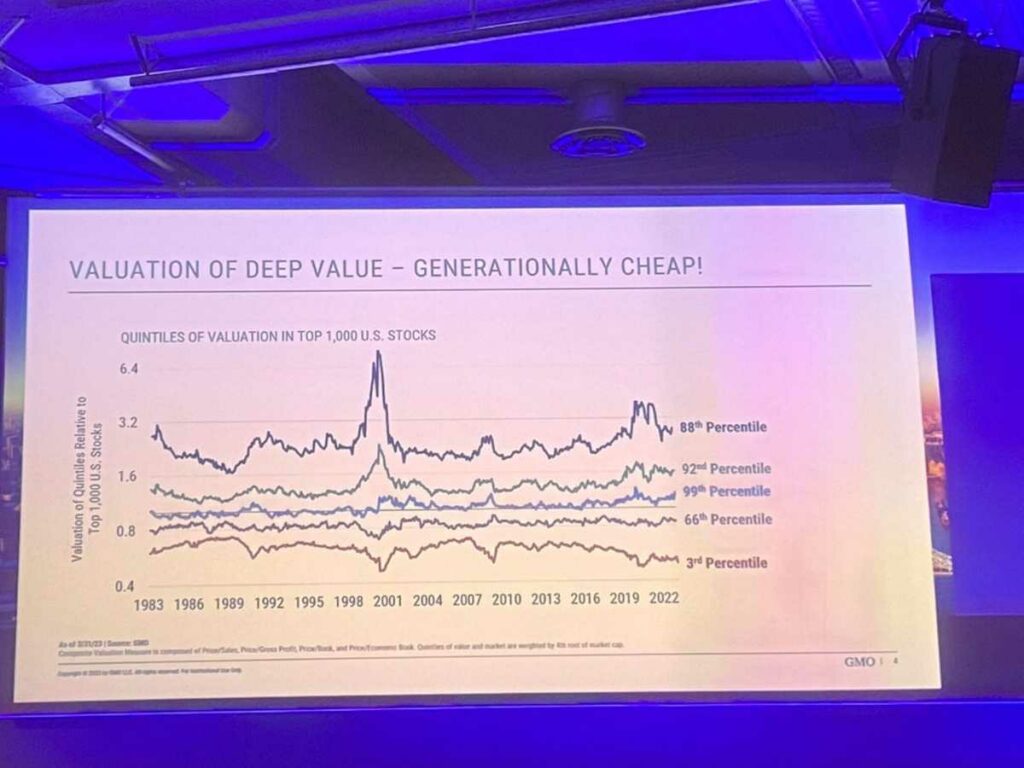

Let’s start with the deep value investing definition. What exactly is this type of investing? To put it simply, it is the process of buying stocks well below their intrinsic value.

Suppose that someone offers you a $1 note. Instead of paying $1 for the note, you are paying only 50 cents, a significant discount on the note’s net worth. That’s more or less what deep value investing is.

At a glance, the concept is simple. However, for the investment to succeed, there are two elements needed: a valuation methodology and a large margin of safety. This is where things get complicated.

To complicate things further, investors will need to sift through the market’s noise and pessimism, which is not an easy task, to find stocks that have been mispriced by a significant margin that the situation warrants.

Undervalued bargain stocks are “cigar butts” as Warren Buffet calls them. These “cigar butts” still have profits to offer on their last puff.

Is Deep Value Investing for You?

Now you know the definition. The next question is, is the deep value investing strategy for you? For starters, deep value investment is not everyone. It is the most fitting for brave and contrarian investors.

It is a game that professional investors struggle to play as oftentimes the hands that are dealt out are small caps. Usually, stocks get cheap when the share price drops significantly. Consequently, the stock’s liquidity dries up.

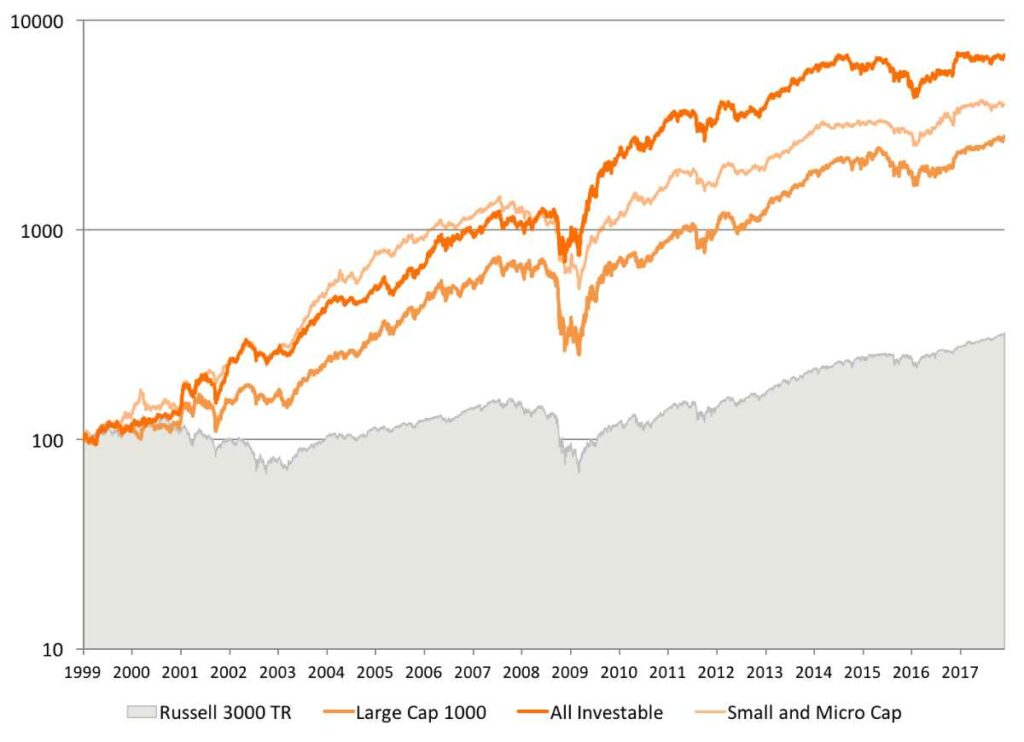

With passive indexing becoming more popular, mega passive index funds now manage trillions. As pressure on fees continues, active funds get larger and larger so they can compete.

As a result, only a small amount of professional investors are doing deep value investing. The micro and small cap areas of the market are just not for them. It is not a game for them to play.

To be exact, this is not a game for investors with money they can’t afford to lose or need in the short term. If you have skills, time, and money to spend, the deep value investment strategy can be the right strategy for you.

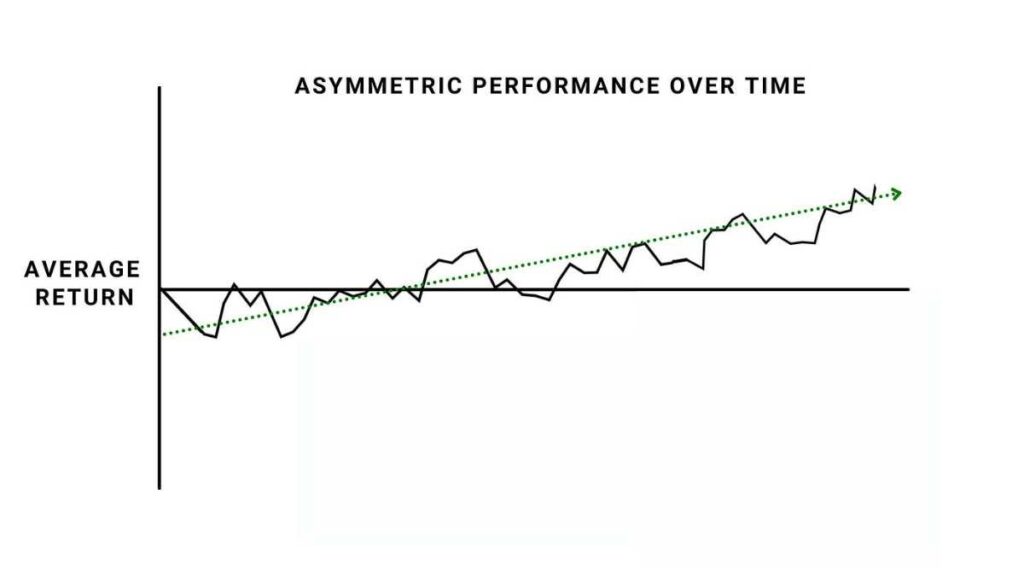

While there are periods of underperformance, deep value investment is among the most consistent return sources in markets. It is certainly not an easy task and requires a keen interest in the financial statements.

Identifying Deep Value Stocks

If you think deep value investing fits you, you may want to identify bargain stocks. Below, we explain two of them. The first is the classic “Net-Net” stock evaluation popularized by Ben Graham and the second is Toby Carlisle’s Acquirer’s Multiple approach.

1. Net-Net

The Net-Net method refers to stock trading at a discount to the current asset value of said stocks. While this method was created decades ago, it continues to outperform. Here is the Net-Net formula:

Net Current Asset Value = Current Assets – Total Amount of Liabilities – Preferred Shares

What makes this method great is it not only provides investors with a very conservative valuation for the business but also provides a huge margin of safety. It is no wonder if the Net-Net method is still popular decades after its inception.

2. Acquirer’s Multiple

A method created by Tobias Carlile, the Acquirer’s Multiple is relatively new to the investing strategies scene. The Acquirer’s Formula is

Enterprise Value (EV) / Earnings Before Interests, Taxes, Depreciation, and Amortization (EBITDA)

Here, EV is Enterprise Value, which is the sum of Market Cap and Debt minus Cash.

The method provides investors with a fuller picture of the true cost of business acquisition.

Challenges for Investors

1. The company is too illiquid or small to buy

Before you do deep value investing, you need to realize this: Most deep value stocks are very small. The good news is that it is possible to filter the most illiquid extremes and set limit orders.

2. The company is going to bust

When looking at a deep value stock, people often see a company with problems. Troubled business models, debt, concern about receivables, and so on. While some corporate raiders could go in and right the wrongs themselves, it is not for everybody.

3. The company is at the top of its earning cycle

Understand that some companies can be cyclical and you might find them at the top of their earning cycle. This is a common concern. When the going is good, these companies do well. When the going is bad, they do poorly.

Also Read:

- Parking Lot Investment: Is It Profitable?

- How To Invest in Solar Farms? Complete Guide

- What Is An Investable Asset? Explained

Concentrate or Diversify?

Some investors like Warren Buffet would concentrate on a single stock. Some others like John Templeton or Walter Schloss would buy 100 stocks or more. So, which one should you do? Concentrate or diversify? It all depends on your mindset.

If you are a full-time investor and know what you are doing, concentrating your portfolio on 8 to 10 stocks may be the best option. For the rest of us, diversifying by owning at least 16 to 20 deep value stocks may be the best.

How Long to Hold Onto Stocks for?

The optimal stock holding period is about one year, according to various studies into Net-Nets. The longer a position is held beyond a year, the lower its annualized return may be. This, however, doesn’t mean you should systematically buy and sell your entire portfolio on the same day.

You have to exercise your judgment in managing a portfolio of illiquid stocks. There are Net-Net investors who encourage selling after 2 years or on a 100% gain. Beyond this, the opportunity cost becomes too great.

No strategy is perfect. Of course, deep value investing is no exception. On one hand, it offers excellent returns. On the other, it requires skills, diversification, and time. Understanding what it is can help you make better, more informed decisions regarding which investment strategy to use.