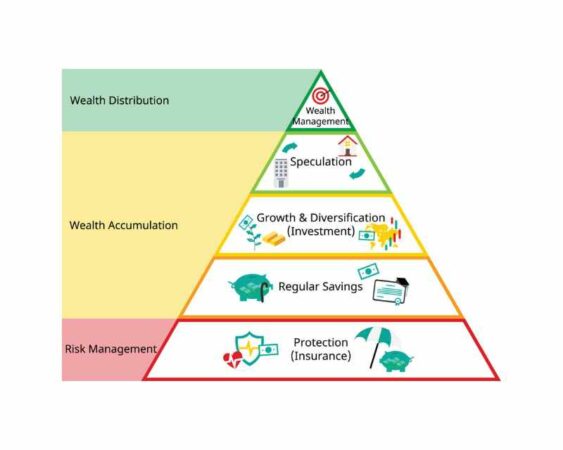

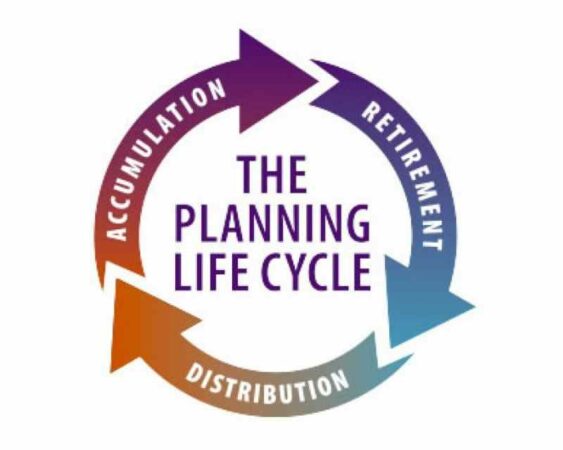

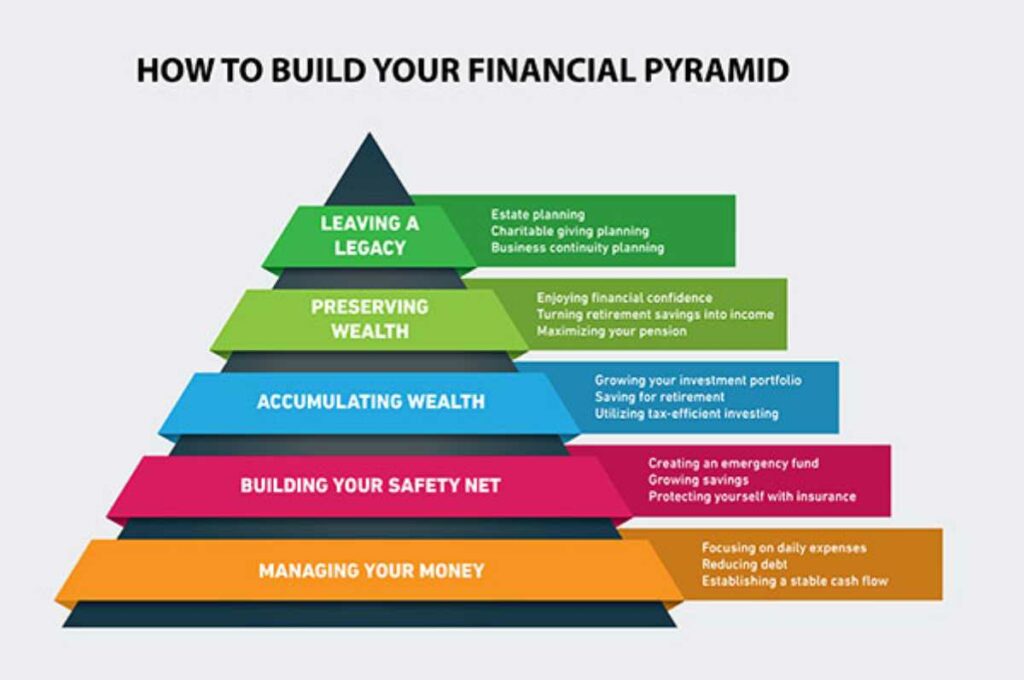

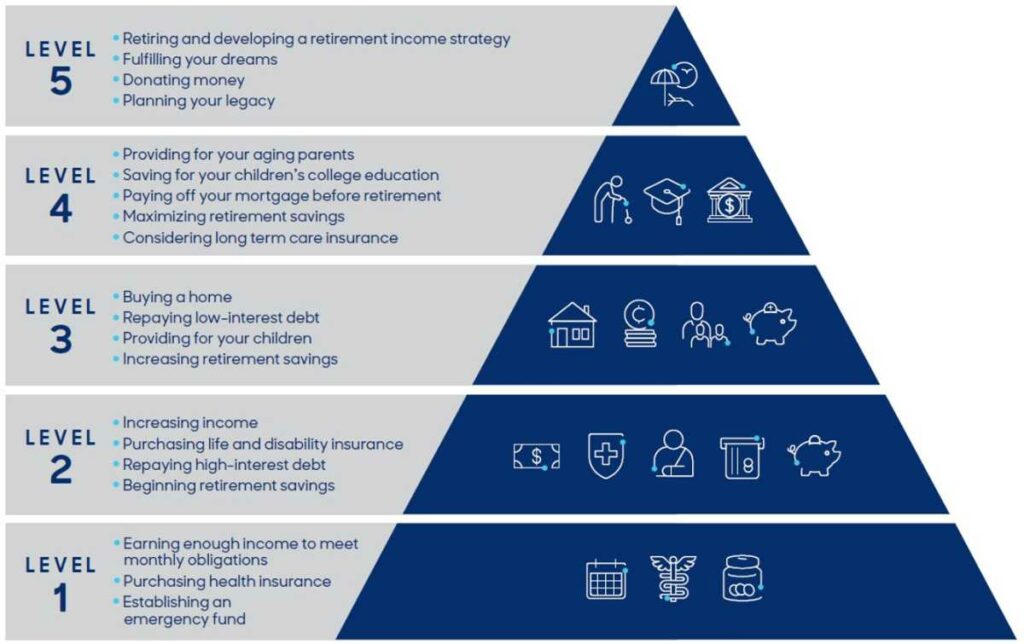

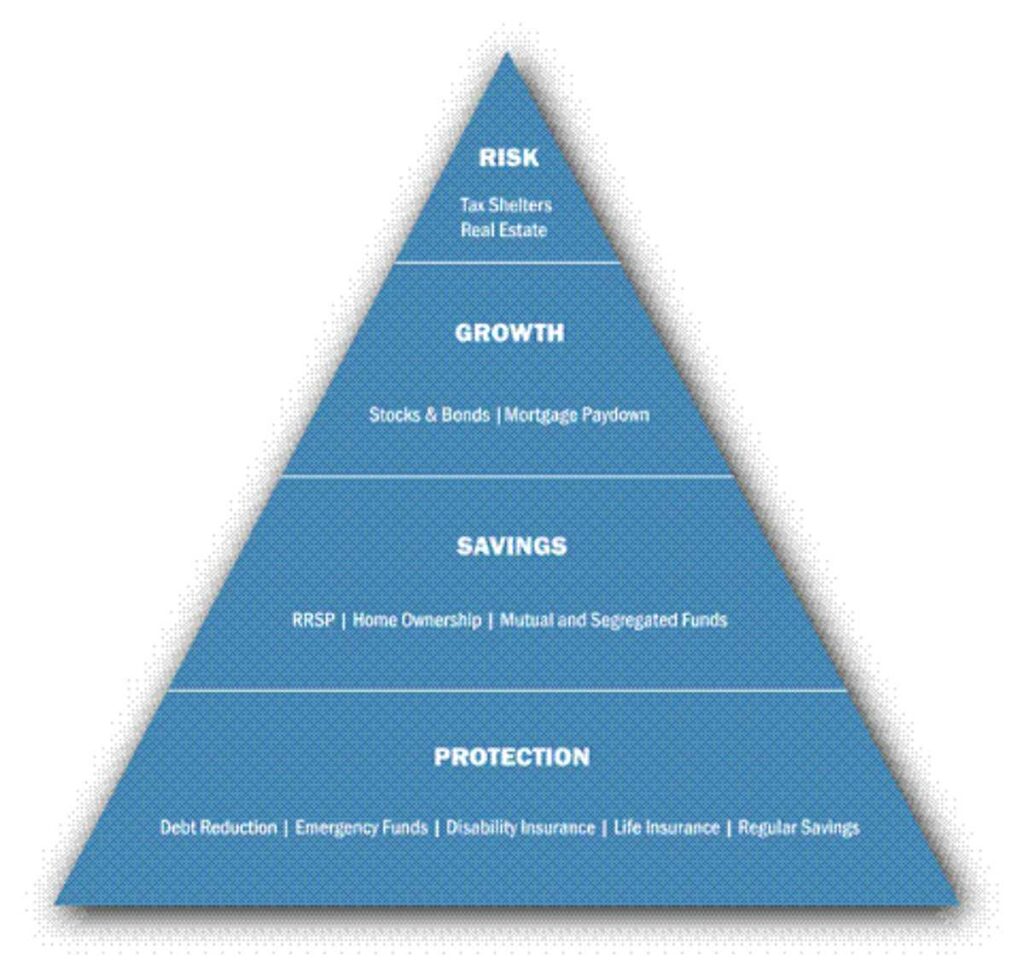

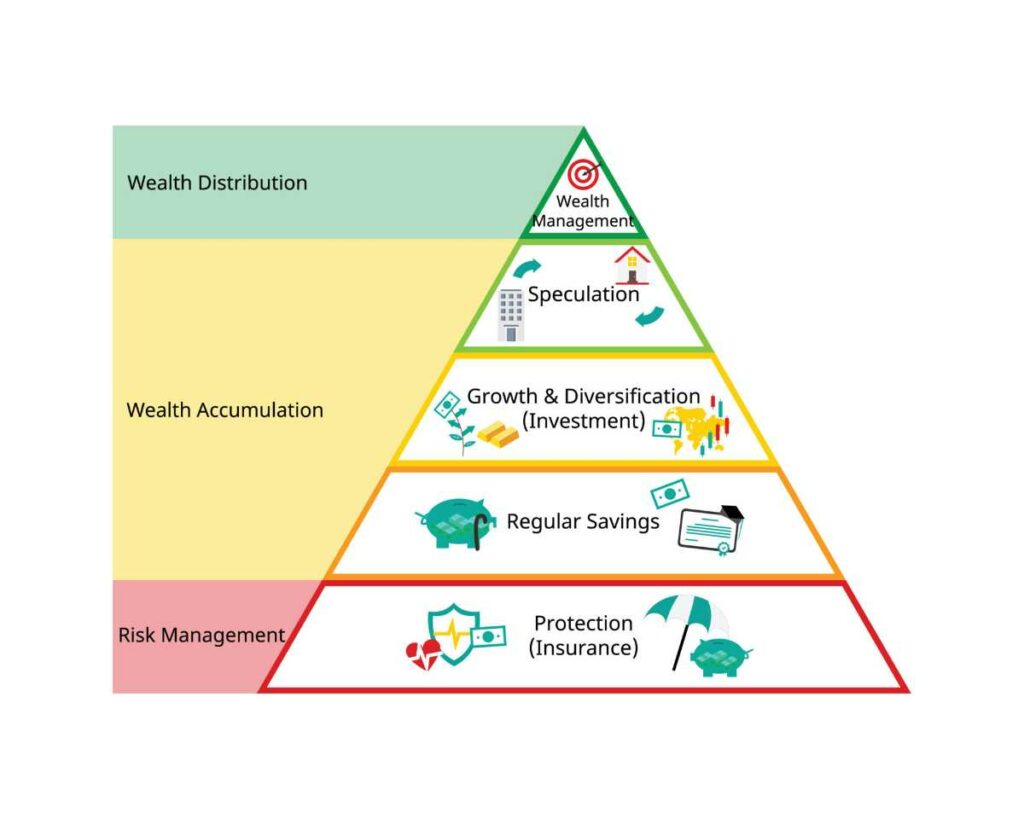

To create a solid financial position, it is essential to set priorities. However, setting priorities can be extremely challenging. The financial planning pyramid is going to provide a visual explanation as well as a reminder so that you can make the right moves at the right moment.

The pyramid is going to keep you from taking any inappropriate risk simply by gauging the relationship between reward and risk. Also, the pyramid can take into consideration the element of time as you make progress towards your financial goals.

Levels and Components of Financial Planning Pyramid

Many pyramids of financial planning are different. Some have many levels while others only have a few levels. Some pyramids describe various investments, financial products, and asset classes while others have some broad categories.

But all pyramid versions have one core element: the least risky financial moves located at the pyramid’s bottom. The riskiest moves are placed at the top of the pyramid. Below are some different levels of the financial planning pyramid.

1. The lowest is the widest

The lowest pyramid’s level is the widest. It indicates the importance of the lowest level and it should be the priority. Also, the lowest level is the least risky and will focus on reducing any financial risk. This level will include home, automobile, health, life, liability and disability, and health insurance.

2. The emergency savings

After addressing the first level, you can be concerned with the second level. The second level will focus on emergency savings. This will include money you put into some safe investments like federally insurance bank savings and checking accounts, government bonds, and certificates of deposit.

3. The riskier level

When organizing a financial planning pyramid, keep in mind that the third level is riskier than the previous levels. This level consists of investment and savings vehicles that can pay higher interest rates compared to the safe ones in the lower level. However, the risk is also greater.

This riskier level can include high-grade corporate and municipal bonds, money market accounts, and bond funds.

4. Investments in equities

At this higher level, investments in equities start appearing. These investments in equities take the form of balanced high-grade shares and mutual funds of convertible bonds and preferred stock. The higher level can also consist of shares of blue-chip public companies and investments in real estate.

Also Read:

- Financial Life Planning: Definition, Components, and Strategies

- Stages of Financial Life Cycle

- How to be a Financial Genius: A Ultimate Guide

- 5. Investments in collectibles

The fifth level of the financial planning pyramid represents investments in lower-grade bonds, speculative stocks, mutual funds, and collectibles. Finally, at the top of the pyramid which is also the narrowest one, there’s a small amount of assets.

You can use the small amount of assets for highly speculative investments that may include over-the-counter penny stocks, commodities, and others.

Pros and Cons of The Pyramid of Financial Planning

Balancing the potential limitations and strengths of the pyramid will help you use the pyramid as a very effective tool while you’re tailoring it to your own specific situations and needs. Below are several cons and pros of financial planning salary guide everyone should learn.

1. Pros of the pyramid

A holistic financial view, risk management, and a structured approach are some pros of the pyramid. If you want to know more, the details below are going to help.

- The pyramid offers a holistic financial view or a comprehensive picture of your entire financial landscape. With this view, it will be easier to identify redundancies, gaps, or even areas you should give more attention.

- Risk management is another benefit of the financial planning pyramid. By playing insurance and emergency funds at the pyramid’s base, the pyramid is going to underscore the importance of building a safety net against financial adversities.

- The pyramid also offers a structured approach or a step-by-step guide that will help you organize and prioritize your financial goals from basic necessities to advanced aspirations.

- This pyramid also promotes long-term and disciplined planning. By visualizing your journey from all foundational needs to more speculative investments, you will be able to stay disciplined in your financial decisions.

2. Cons of the pyramid

Understanding the financial planning key components won’t be enough. Consider the cons of the pyramid so that you’ll be ready with anything.

- The financial world keeps evolving with new strategies, technologies, and instruments. The pyramid may need regular revisions so that it can stay effective and relevant.

- Though the goal of the pyramid is to simplify your financial planning, the pyramid’s multitude of components and layers may confuse or overwhelm financial planning novices.

- If you follow the pyramid too rigidly, there will be a risk that you may become too conservative since you will only focus on the base layer excessively and will miss out on the beneficial financial opportunities offered by the higher layers.

- One size of the pyramid doesn’t fit for everyone. The pyramid may provide a general framework. However, the financial situation of everyone is very unique. Adhering strictly to the pyramid may not fit for individual circumstances of everyone.

Though the financial planning pyramid will help you simplify your financial life, it may not be the best method for you. Check out the pros and cons of this pyramid before making your own pyramid.