Your life follows some stages that make up the financial life cycle, from the time you first earn your own money to the time you enter your retirement. Each stage is determining what you should be doing to maintain your financial health.

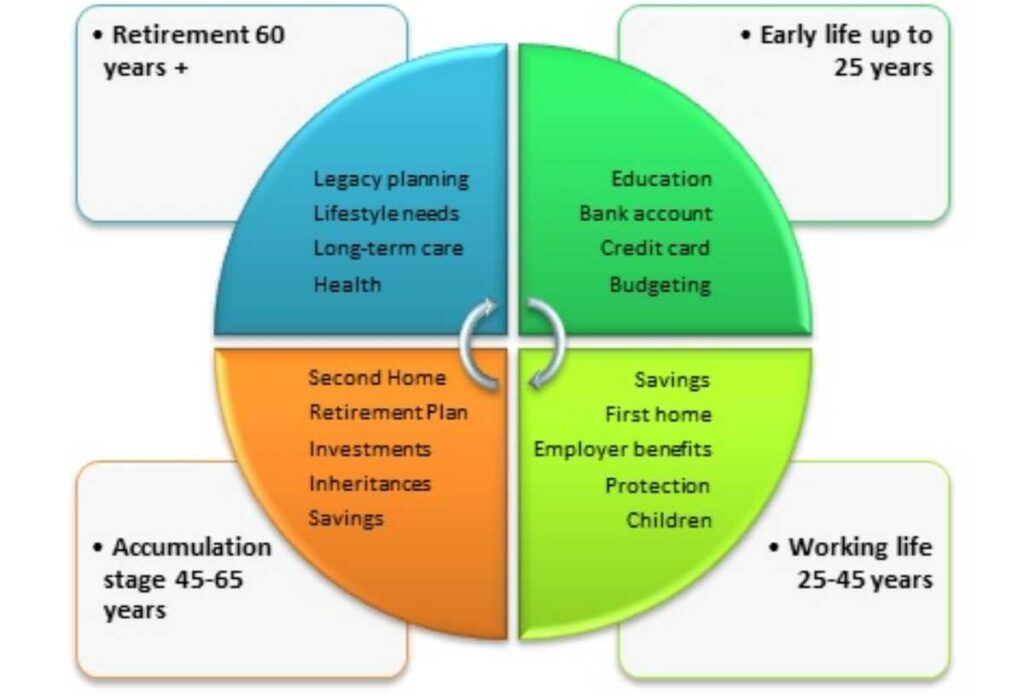

There are four different stages or phases people go through, as well as accompanying financial milestones people experience, as people progress through their life cycle financially. What are the different phases or stages?

Stages In Personal Financial Life Cycle

The four stages or phases in this life cycle include the early career as the first stage and becoming established in the next stage. Stage three is nearing retirement and the final stage is the retirement. Below are the four cycles in people’s financial lives.

1. Early career

As you enter your careers, you usually earn a smaller income compared to later in your careers. Already, you may have accumulated debt in this period, for example, the student loan debt. Some people even get married and start a new family in this life stage.

Some others borrow money and buy a house, which makes loans and the unavoidable subsequent debt. The best thing to do in this financial life cycle is to develop good financial habits from the beginning. If possible, spend less than you earn while saving as much as you can.

But if you have high-interest debts that are going to be better paid sooner, it is crucial to prioritize paying the debts back over stockpiling the savings. This early career stage is also the best time to plan long-term financial plans.

2. Becoming established

As you become more established in your career, you may earn a higher income while having more experience in managing your finances. Then there will be less emphasis on managing cash flow and income. Instead, the focus is more on the growth and management of wealth.

In this second of the financial life cycle stages, you may want to invest in different investments to diversify your income sources. Or, you may want to invest in funds or stocks in the stock market.

In addition to growing your wealth, the becoming established cycle must be accompanied by detailed future planning. This is going to include saving for future expenses like kids’ education and preparation for eventualities like illness and death.

3. Nearing retirement financial life cycle

When you are getting closer to your retirement, you are going to see more clearly whether the earlier stages’ plan can support the retirement you desire. This is the time to adjust the plan and consider any life changes that will affect the cost you need for retirement.

For example, you may want to consider your health concerns as well as your new retirement ambitions like traveling the world. This is also the best time to work toward paying off all outstanding debts, especially mortgages.

In the end, you can walk into the next financial aid life cycle debt-free. You won’t have to account for any debt repayments within the retirement plan. Do whatever you can to grow the investments and increase the savings.

4. The retirement

The last of the four stages is the retirement. This is when the golden years welcome you. However, this is also the stage of uncertainty. There will be no income from the employer. You are going to pay yourself from the money you have accumulated over the previous stages of the financial life cycle.

The most important thing to remember is now to overspend your money early. Making rash financial decisions, especially in the first few years of your retirement will leave you scrape in the later years of your retirement. You don’t want to experience it.

Employ the genius budgeting skills you have learned in the first financial life stage. That’s how you can be sure you know to maintain the standard of living throughout your retirement while accounting for any rise in costs related to health and any possibilities in assisted living.

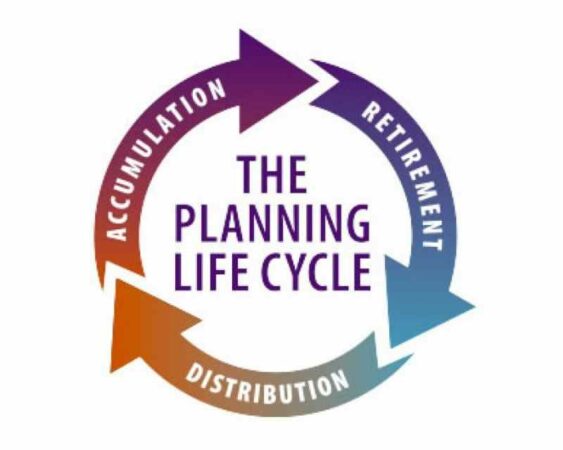

Alternative Concepts to Financial Planning Life Cycle

The stages above aren’t the only concept of a cycle in financial life. Another concept consists of three different stages.

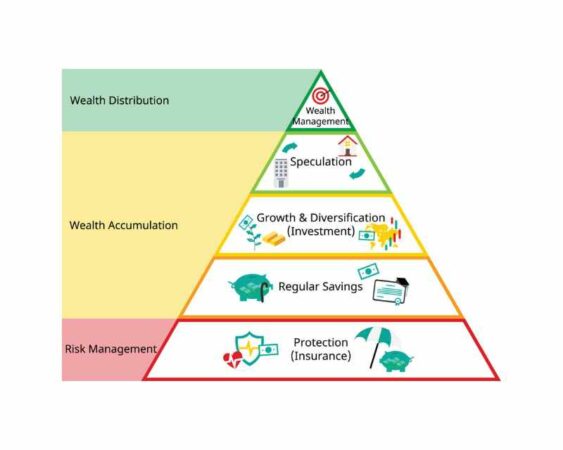

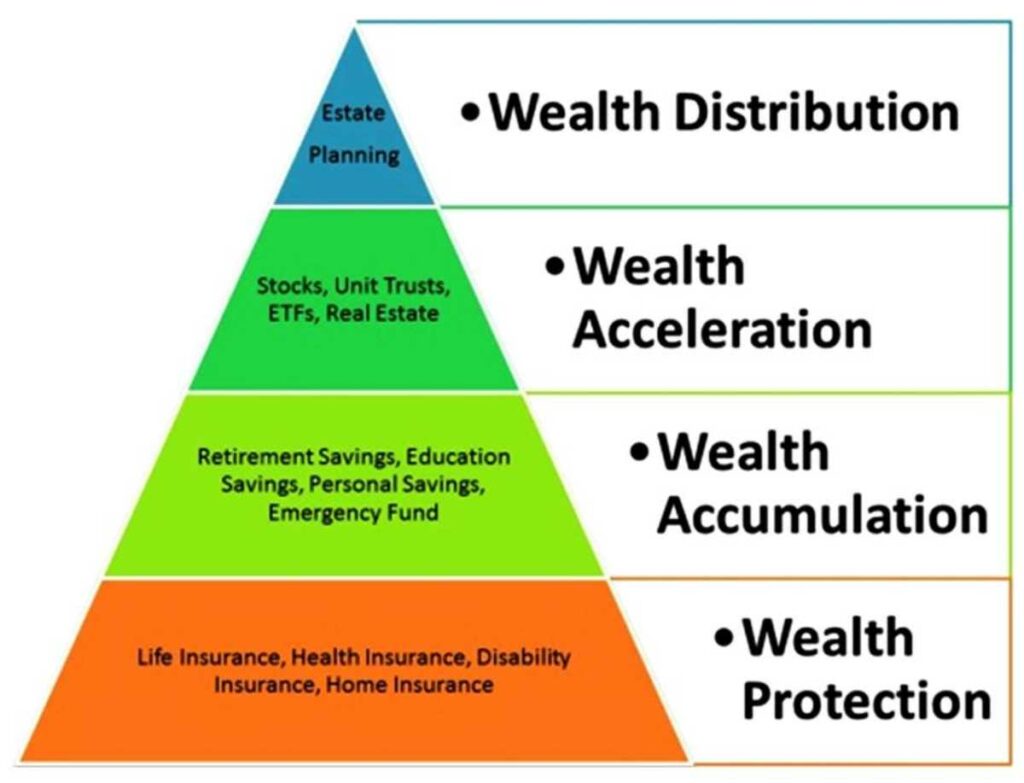

1. Wealth accumulation

This is the moment when you embrace your daily grind and put in the entire work to build a foundation for your legacy. The stage is about saving and planning everything for a brighter future. It means this stage is where you also start your retirement planning.

2. Wealth preservation

With your groundwork done, comes the moment to secure everything. This is the time when you start considering retirement planning after years of accumulating wealth in your working life. In this stage, you will re-evaluate your investments and what you want to get after retirement.

3. Wealth distribution

It is the final stage where all your investments and savings will pay off. You need to arrange things completely, like making your end-of-life planning and estate planning.

Each stage in the financial life cycle is crucial. You need to start correctly so that you will be able to enjoy your retirement more comfortably.

Also Read:

- Financial Life Planning: Definition, Components, and Strategies

- Financial Minimalism: Simplifying Your Finances for Peace