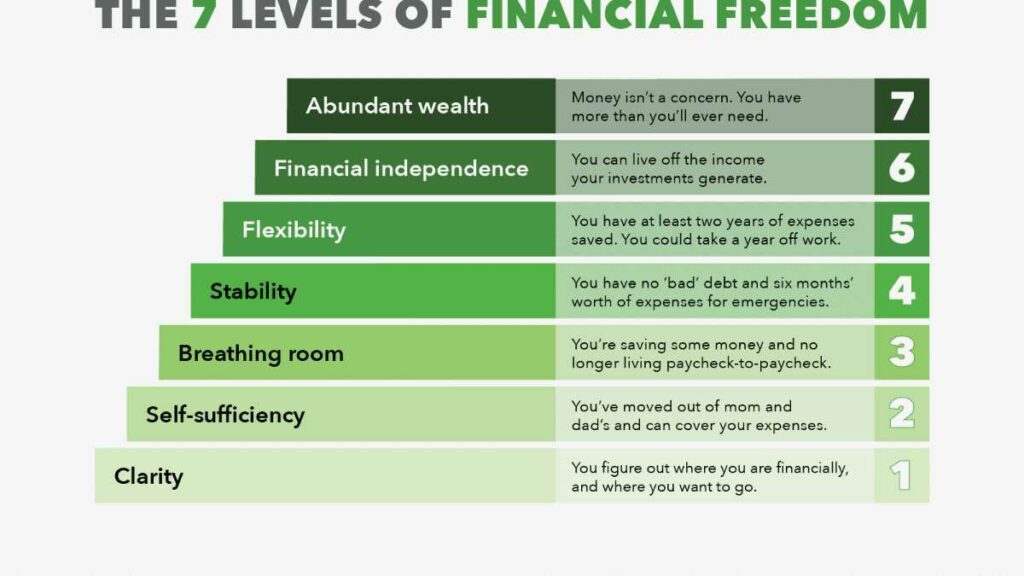

Kahnattorneys.com – Many people want to achieve financial freedom as their goal. It is a good goal since being financially free means you have investments, enough savings, and cash on hand so you can afford the desired lifestyle. Some steps to financial freedom will help you achieve freedom in your financial life.

Financial freedom also means growing a beautiful nest egg that’s going to let you pursue any career you desire or retire earlier. Unfortunately, many people are far behind in their financial freedom. Even with no financial emergencies, overspending that’s causing escalating debt becomes their burden.

Habits That Lead To Achieve Financial Freedom

Being financially free or independent means having enough income, investments, or savings to live comfortably while meeting all obligations without having to rely on a paycheck. This is the ultimate goal of many long-term financial plans. To achieve the goal, these habits will help.

1. Set your life goal

How do you see financial freedom? Everyone has their own general desire for financial freedom. However, financial freedom is a goal that can be too vague. You must be really specific about deadlines and amounts.

The more specific goals you own, the higher your possibility to achieve them. To decide your life goals, try to write down the lifestyle you desire and what it requires. Also, you need to know how much money is in your bank account if you want to make it possible.

Finally, write down the age that becomes your deadline to save the amount you desire. Then, the next steps to financial freedom are counting backward from the deadline age to the current age and then establishing financial mileposts between those two dates.

Always write all deadlines and amounts down carefully before putting the goal sheet in front of your financial notebook.

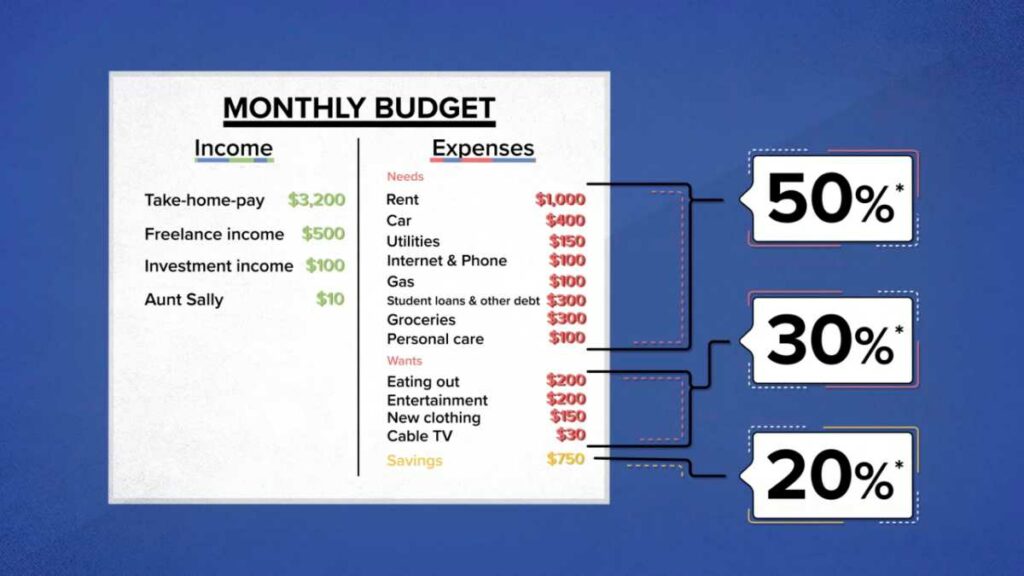

2. Set up a monthly budget

Creating a monthly budget and sticking to the budget is the right way to guarantee that the entire bills will be paid and all your savings are always on track. It is also a great regular routine that will reinforce your goals while bolstering your resolve against the desire to splurge.

How can you make your own monthly budget? If you have no idea how to start, a lot of money master websites offer helpful budget planner templates to use for free though many others are paid. Use those templates to start before you can make your own monthly budget.

Also Read:

- What is Financial Considerations in Business?

3. Pay off your credit cards in full

High-interest consumer loans like credit cards are very toxic to your financial freedom. Always pay off your credit card’s full balance every single month. Mortgages, student loans, and other similar loans usually have lower interest rates.

Paying those loans off isn’t as emergency as paying off your credit cards in full. However, it is still important to pay those lower-interest debts on time. Moreover, on-time payments are going to build a great credit rating.

4. Steps to financial freedom: set up auto-savings

Before paying others, pay yourself first. You can do so by enrolling in the retirement plan offered by your employer while making full use of all matching contribution benefits which are essentially free money. Having an automatic withdrawal into your emergency fund is also a brilliant idea.

You then can you the money in your emergency fund for any unexpected expenses. In addition to auto withdrawal to your emergency fund, you should also consider an automatic contribution to your brokerage account.

The money for your retirement or emergency fund should be pulled out of the main account the same day you get your paycheck. That’s how you keep it away from your hands.

5. Start investing immediately

One step that’s going to help you succeed in building wealth is investment. However, bad stock markets may make many people question the effectiveness of investing. However, there is no better way than investing to grow your money automatically.

The compound interest’s magic itself is going to grow the money you invest exponentially. However, you need to wait to achieve meaningful growth. Consider opening an online brokerage account. This account is going to ease you in learning the best way to invest.

Create a portfolio you can manage and make monthly or weekly contributions to the portfolio automatically.

6. Always check your credit score

A good credit score is a very essential number that’s going to determine the interest rate that will be offered to you when you refinance a home or buy a new core. This number will also impact the amount you are going to pay for life insurance or car insurance premiums.

Checking your credit score is one of the crucial steps to financial freedom you should take. It becomes highly essential because people with reckless financial habits are considered reckless in other aspects of life, like not looking after their own health.

That’s why you need to get your credit report regularly and make sure that there are no black marks that are going to ruin your reputation.

7. Get education on financial issues

The next of many keys to financial freedom is reviewing relevant changes, especially in tax law. This is to ensure that the entire deductions and adjustments are maximized every year. You also need to keep up with all financial developments and news in the stock market.

Never hesitate to adjust the investment portfolio you own according to the latest financial updates. Knowledge is always your best defense against any fraudsters who are preying on unsophisticated investors who always want to earn money more quickly.

8. Take care of your health

To be financially free, it is essential to maintain everything properly, including your body. Taking good care of your own physical health is going to have a positive impact on your financial health. It isn’t hard to invest in good health. Regularly visiting dentists and doctors is the first step.

You may also want to follow health advice about all problems you face. A lot of medical issues can be prevented and helped with basic lifestyle changes, like a healthier diet or exercise.

More steps to financial freedom are actually available but the 8 steps above should be on top of your list. Keep yourself healthier so that you can keep your finances healthier as well.