Financial genius people aren’t people who understand everything about finances and financial life. Those who are genius in finances know the right things. These genius people have become extremely successful in making money and they know the right things about finance earlier in life.

Everyone can become a genius in finance since handling money is in humans’ genes. It is like a skill you need to sharpen simply by reading financial books and practicing everything you’ve learned. Unfortunately, schools don’t teach everything about finance and financial life.

What Makes People Financially Genius?

Understanding the financial genius’s meaning won’t be enough. Everyone should also know the characteristics of genius people in finances. This way, you’ll figure out whether you’re a genius in finance or you’re on your way to it. Below are some characteristics of genius people in finances.

- Genius people don’t work to earn money. Instead, they make their money work and give them even more.

- Genius people are in charge of the finances they own, they aren’t dependent on government, company, or parents.

- Those who are financially genius also know that it is much easier for them to get a job. However, they know it is wiser not to be too dependent on earning income from a job.

- Genius people in finance understand that it takes time to build their wealth. However, they will take it anyway.

- Those who are financially genius understand the advantage of building wealth instead of only doing a job.

- Genius people keep developing various sources of passive income so they don’t have to work hard to earn much more money.

Steps To Become A Financial Genius

Now that you know the characteristics of a financially genius person, you’ll see whether you’re close to it or not. Then, you’ll need to figure out how to be a genius in finances so that you’ll earn a much easier life. The steps below are going to help you live as a financially genius person.

1. Adopt frugal lifestyle

Always ask yourself how often you go out for dinner or cinema, buy clothes you don’t need, and swap your credit card though you know that you can’t afford the product. Knowing the answers will let you see whether you’re living frugally or not.

If the answer to the question worries you, then you need to take action so that you can become a financial genius. Practicing frugality is something you have to do. Even though you know that you have adopted a frugal lifestyle, you need to maintain what you’ve done.

2. Party, but control yourself

Many people love to party, you’re not alone. But any excessive party is going to draw a huge hole in your pocket. Socializing is always a nice thing. Everyone loves meeting and hanging out with relatives and friends. However, hanging out doesn’t need to be in fancy bars, paid clubs, or restaurants.

You can even socialize with your loved ones in public places. This is going to help you control your spending. Partying in public places or at home is going to help you save more, a lot more than you can imagine.

3. Get an insurance policy

Another step to take to be a financial genius is getting an insurance policy. insurance may seem like a cost. However, it is crucial for your financial management. Financial management will not only deal with different methods of money multiplication.

It can also take care of your uncertainties in life. In normal days, your investment is going to take care of whatever you need. But on tough days, insurance coverage is going to take care of your urgent needs. They both help in different ways and in different situations.

4. Increase your financial intelligence

Only a small amount of people around the world are financially knowledgeable. Those people made informed financial decisions while building their wealth gradually. Most people around the world don’t know finance. They earn money only to spend it and survive.

It is crucial to keep increasing our financial intelligence. Reading good financial books is going to help. But make sure that you know what you read. And don’t just read, get knowledge and guidance from those books you read. Then, practice them all in your financial life.

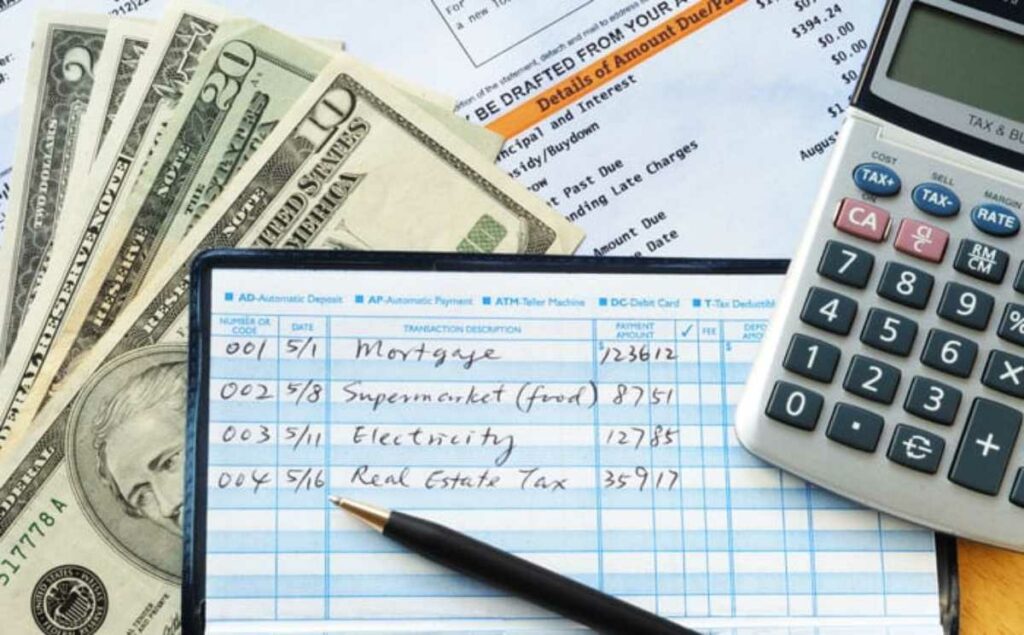

5. Budget expenses on your little ones

Kids can be extremely expensive. However, parents can get help by budgeting and identifying extra costs. Entertainment, gifts, personal care, medical, and education are some expenses that will happen to kids. Genius parents will carefully budget expenses for their kids.

Financial genius people will also track the expenses of their kids. It is going to bring down the cost dramatically. It is always better to save for your kids instead of overspending on them. Make sure that you have enough for their future than for their today.

Also Read:

- Financial Life Planning: Definition, Components, and Strategies

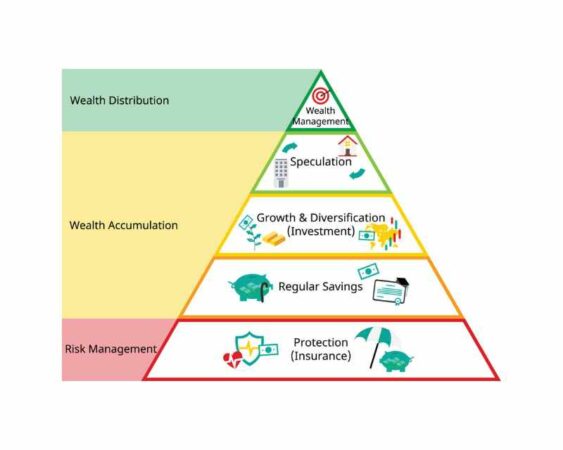

- What is a Financial Planning Pyramid?

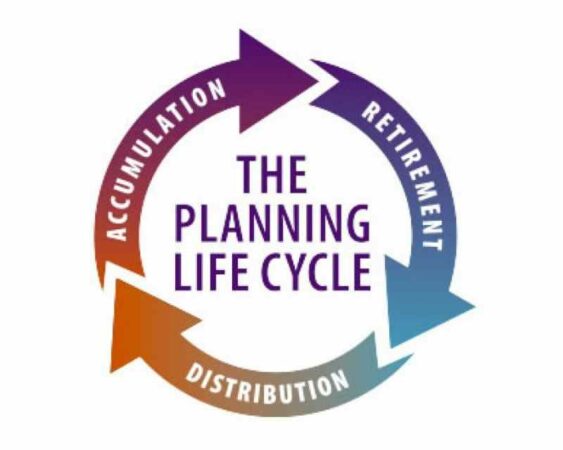

- Stages of Financial Life Cycle

6. Watch your credit ratings

Why do you have to know about your credit ratings? A good credit rating always means that things have been done the right way. If you have a good credit rating, then you meet the financial genius definition and you have to continue being like that.

But, if you’ve got a poor credit rating, you need to bring changes, especially in the way you handle your money. Knowing your credit rating is like doing reality checks periodically.

7. Involve your family in managing money

Money management is not something you can do alone. A wise alternative to consider is including all your family members. First of all, you may want to start with setting up a financial goal. It can be purchasing a home, a new car, going on a long vacation, or anything else.

Then, all members of your family must know how they should contribute to meet the budget and achieve the financial goal. More involvement is going to help your family achieve your financial goal much quicker with less struggle.

8. Reduce the cost of air conditioning

Note that air conditioners may cost very dearly. The electricity bill on normal days can be USD30. And in summer or winter, the bill can climb up to USD65. Instead of relying on air conditioners, consider using darker shades on your glass windows.

Becoming a financial genius person is a beautiful goal everyone should try to achieve. You can achieve this goal by following the eight easy steps above along with your family members.