Before starting any business, there are legal and financial considerations you should learn. Starting a new business may be exciting and filled with possibility and hope. However, along with the excitement, you need to focus on the essential considerations.

The initial steps everyone should take in starting a business are choosing the right entity and understanding tax laws. Any decision you make at the start of the business journey is going to impact the business’s success in the future. What considerations to know before starting a business?

Business Financial Considerations Everyone Should Know

Budgeting should be the first financial step to be done when you start a business. After knowing how much you will need, focus on gaining funding. Then, it is also crucial to understand tax obligations and keep your financial records accurate. Here are more details about those considerations.

1. Making a realistic budget

A realistic budget becomes an essential consideration to start a new business. There are some key points all business owners should keep in mind:

- Identify the entire start-up costs including supplies, equipment, utilities, and rent.

- Estimate all ongoing expenses that include insurance, marketing, and salaries.

- Determine the projected revenue so that you can set much more realistic sales goals.

- Plan for all unexpected emergencies or expenses.

- Regularly evaluate your budget and make any necessary adjustments.

By making a thoughtful and thorough budget, you will be able to avoid any financial pitfalls. Your realistic budget will also ensure the long-term success of the new business venture.

2. Financial considerations: gaining funding

Gaining funding becomes the second essential consideration to start a new business. Entrepreneurs can secure funding simply by exploring different options like crowdfunding, personal savings, venture capital, grants, or bank loans.

Every single option is going to come with its disadvantages and advantages. A bank loan usually requires a strong credit history and collateral. Venture capital usually involves giving up several controls over your business.

Crowdfunding may be an excellent way to generate funds and interest, but it requires a lot of effort without promising the desired results.

3. Managing funding

After obtaining funding for a business, it is crucial to manage your funding wisely. Proper financial management is going to help ensure that your business will stay on track and grow sustainably. This step will include monitoring cash flow and expenses and keeping accurate records.

You should also conduct regular reviews while adjusting your budget if necessary. Overall, gaining and managing funding is a complicated yet essential step in starting a new business. Entrepreneurs should carefully weigh their options while preparing to attract potential lenders and investors.

With financial management and careful planning, entrepreneurs will be able to turn the business ideas they have into successful ventures.

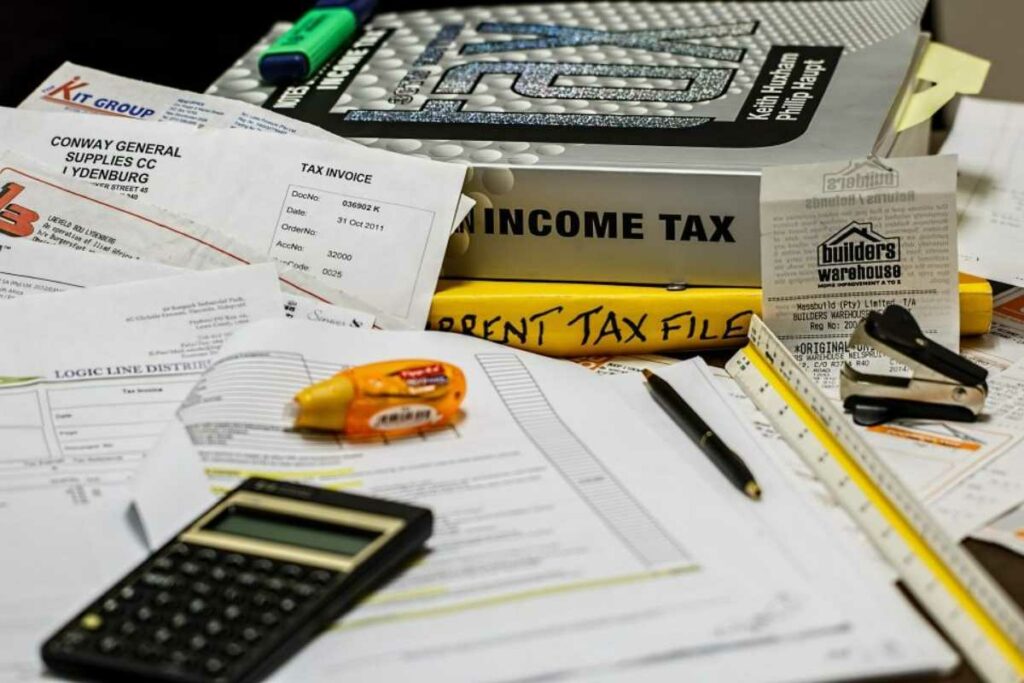

4. Understanding tax obligations

Those who start a business must understand their tax obligations so that they can avoid all financial issues and legal issues. Below are some key things entrepreneurs should keep in mind:

- Local, state, and federal taxes

Depending on the location of the new business and the business type, you may have to pay local, state, and/or federal taxes. It is essential to understand various types of taxes as well as how those taxes will apply to your business.

- Sales tax

A business that sells services or goods may have to collect sales tax from their customers. If you run this kind of business, then you need to understand the regulations and rules around the sales tax where your business is running.

- Payroll tax

If your business will have some employees, then you have to withhold taxes from your employees’ paychecks.

Then it is critical to pay the payroll tax to the appropriate taxing authorities. Employers are also responsible for paying employer taxes like medicare tax and social security tax.

Make sure that you work with any qualified tax professional so that you’ll understand financial considerations related to tax obligations. This is how you keep the business in compliance with any law.

5. Keeping accurate financial records

If you want to succeed in your business, it is crucial to keep accurate financial records. Several records will be involved, including:

- All financial transaction records are going to help you understand the cash flow of the business as well as the loss or profit your business experiences every month.

- Separating personal and business finances is extremely crucial. Maintaining a separate credit card and bank account for your business will make your tax preparation much easier and improve your record-keeping ability.

- Always monitor and track all expenses. This is an important part of financial considerations since it will help you identify any unnecessary expenses so that you can control them immediately. Consider hiring a professional or using bookkeeping software.

- Record revenue and sales accurately so that you will be able to calculate your business’s future projections and current income. This will assist you in forecasting your business’s future earnings while making necessary adjustments in budgeting.

If you need guidance in keeping accurate financial records, consider hiring a certified public accountant who understands financial factors affecting business. Keeping accurate financial records will assist all businesses in creating financial planning and decision-making.

Legal Considerations in Starting A Business

Financial consideration isn’t the only consideration in starting a business. Entrepreneurs should also learn everything about legal considerations. Choosing the right business structure is the first essential legal consideration. Business structure is going to determine how the business will be taxed.

Also, a strong business structure will help entrepreneurs know how to deal with business debts and handle administrative paperwork. Other legal considerations include gaining necessary licenses and permits, protecting intellectual property, and understanding employment laws.

Note that financial and legal considerations are related. If you skip legal considerations, you won’t be able to set up the financial sector of your business successfully. Make sure that you learn all considerations thoughtfully and thoroughly before diving in.

Five aspects are involved in financial considerations. Entrepreneurs must create a realistic budget, obtain and manage funding, understand and obey all tax obligations, and keep accurate financial records. All those considerations are going to impact the future of the new business.

Also Read:

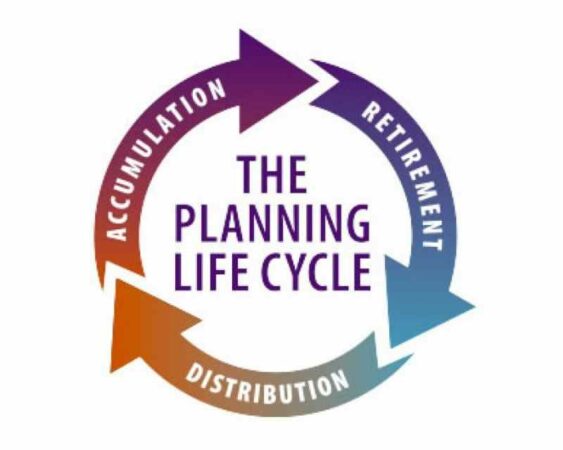

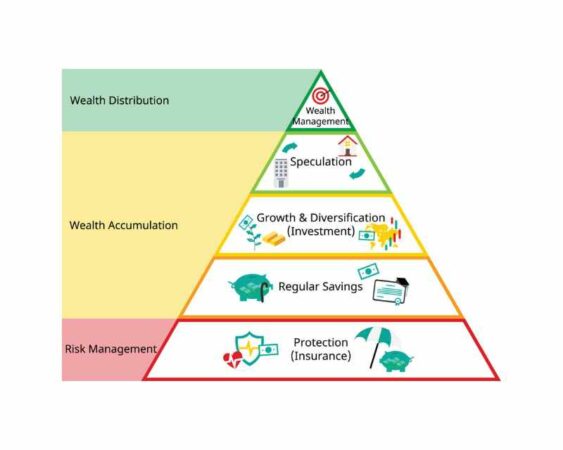

- Financial Life Planning: Definition, Components, and Strategies

- Fundamentals of Financial Planning

- Stages of Financial Life Cycle