Young people who aren’t as financially sound as expected may feel scared of the future. They may not be certain what their life and bank account will be in a decade. This makes them think about how to get ahead financially.

It is a good thought and it will motivate you to start planning the foundation for your financial success and building it immediately. There are a lot of things for you to do and it should start now before you get older or spend your money without tracking it.

The Best Way To Get Ahead Financially

What to do to start getting ahead financially? First of all, you need to pay off all debts since those debts are going to block any plan you have for your financial goals. Then, you can start saving your money and do the other steps explained below.

1. Pay off all debts

Do everything to pay off student loans, credit card debt, or other debts before you enter your thirties. This may seem impossible. Mountainous debts will always look bigger if you see them from the base camp. However, once you start climbing, you will be able to make it to the peak with fewer obstacles.

To get rid of your debts, it is crucial to pay off more than the minimum monthly payment. Then, you need to focus on the big picture of being free from any debt. This is going to help you climb much more easily and be free from debt before it is too late.

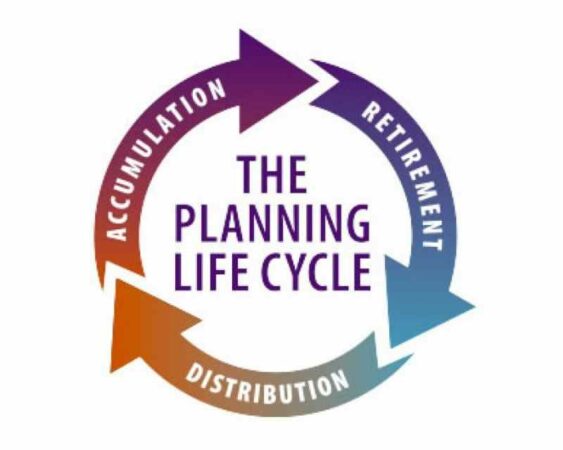

2. How to get ahead financially by start saving

Right now is the right time to start saving for the retirement. Though it sounds a bit early, you want it to be very early instead of late. People in their 50s who are now planning for their retirement are figuring out that there’s not enough money in their accounts to live on.

It makes them have to work into their 70s. Instead of focusing on your vacation today, you should start saving as soon as possible for your retirement. And now is the right time if you haven’t started yet. There are different ways to start saving for your retirement.

For example, you can speak to your employer and set up your retirement plan. Or, you may want to create a specific savings account and don’t ever touch the money in that account until you are 65 years old. You’ll be ready to retire on time and comfortably.

3. Don’t live beyond your means

To get ahead on finances, it is crucial to live below your means. A lot of millennials now understand what it means to live inexpensively. With lower-paying jobs and more college debt compared to the previous generations, millennials are not in a position to enjoy a luxurious life.

But even though you can afford the luxury life and leave the frugality occasionally, you shouldn’t do that. This means you should get an apartment where you can pay easily, buy generic brands, and spend less than your monthly budget if possible.

Simply by cutting costs everywhere and fully believing or pretending that you’re poorer than you actually are, you will be able to find the answer to how to get ahead financially. Then, you will have a lot of money than you can imagine in the future.

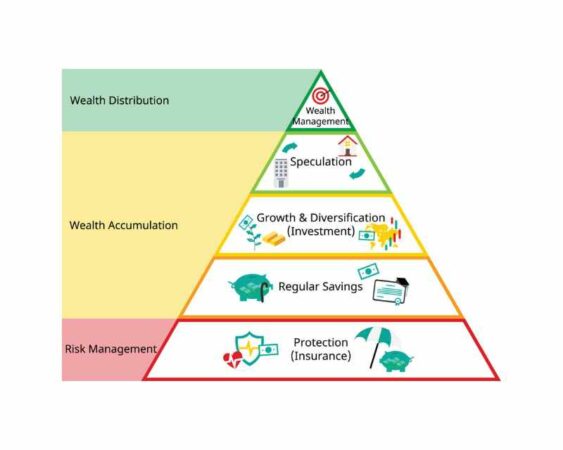

4. Start investing now

If you have done the previous steps, then you need to learn this important step: start investing. Most young people don’t realize the value of investment. Many young people may have one or more savings accounts through the banks that can help them build their futures.

However, those young people don’t take full advantage of the economic potential they have. If you start investing in bonds and stocks before your 30s, there will be a lot of understanding and experience to earn. You will understand how the financial markets are working.

Also, you’ll learn how to get ahead of your finances. With a little knowledge, you will be able to make the right investment that’s going to pay off in wonderful ways in the future.

Also Read:

- Financial Life Planning: Definition, Components, and Strategies

- Stages of Financial Life Cycle

- What is a Financial Planning Pyramid?

5. Be selfies with the money you own

Keep in mind that the only thing you can control is your finances. It means you want to be wise and keep money for yourself. This means you shouldn’t let anyone know about any financial moves you’re going to make. You should also focus on improving yourself before thinking about helping others.

However, it doesn’t mean you cannot be helpful or generous when there’s an opportunity. Everyone loves showing family members and friends how much they care. So, how to get ahead financially without being too selfish?

If you need to establish a better future right now while you’re still very young. It is very important to be only a little selfish. Help others with any extra money you have, not with the money you’ll use for your future.

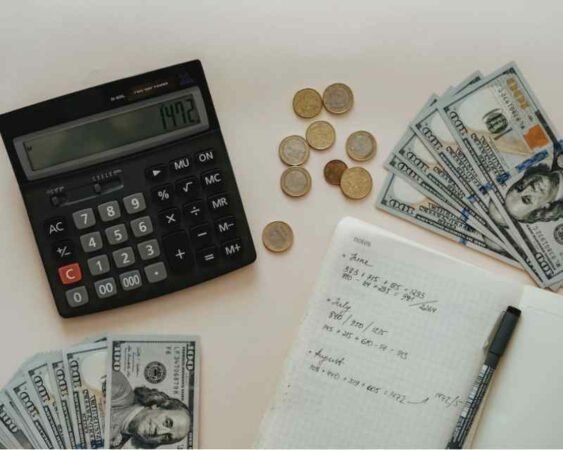

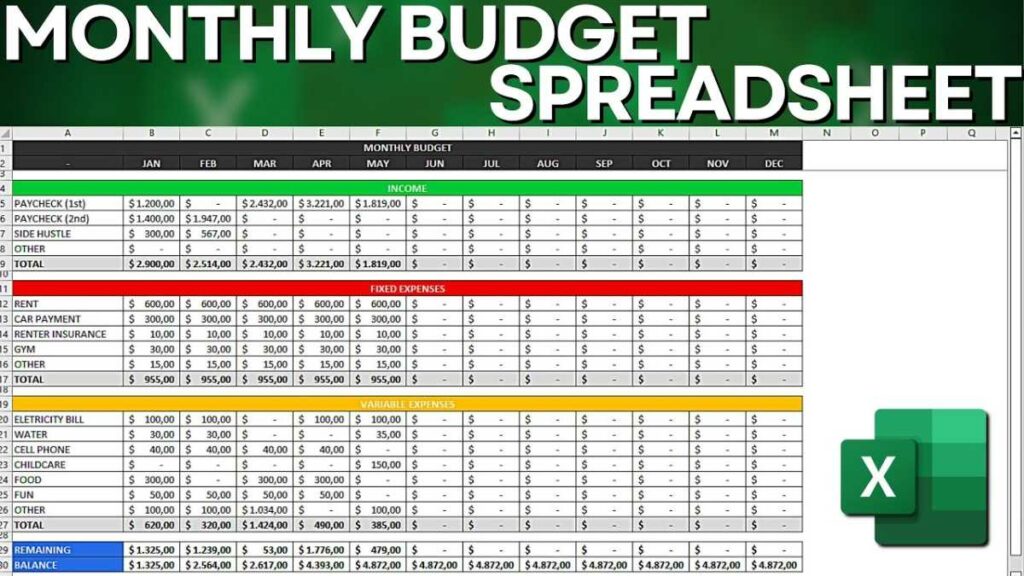

6. Make a monthly budget

You will be able to get ahead with finances by planning for all unexpected expenses and saving money. Budgeting is going to help you learn everything about the money flow you have. Your monthly budget will make sure that you don’t spend more than you earn.

To create a monthly budget, you must first tally up the regular monthly expenses such as mortgage or rent, utilities like gas and electricity, and communication bills like cell phone and internet, groceries, and student loans.

The monthly income you earn must balance out the expenses above and give some leftovers so that you can use them for entertainment. In addition to your retirement savings, you also need to have a specific account for your emergency fund you can use anytime you’re in an emergency.

7. Challenge yourself to a no-spend challenge

Many people refer to no-spend challenges and you can find them on social media. You too can challenge yourself to eliminate purchases of extras like entertainment, books, and clothing for a predetermined period. For example, you can go for a month, two months, or six months.

How to get ahead financially while you’re still young? A lot of methods can help but the 7 methods above are the most critical ones you should do immediately.