Pre-settlement loans are loans designed to help people cover unforeseen expenses. The pre-settlement funding will let you borrow funds against potential future awards, settlements, court decisions, or judgments. How many Pre-Settlement loans can I get?

With pre-settlement loans, you won’t need to worry about paying for rehabilitation, medical care, and recovery. Instead, you can repay the loan advance over time. However, it is crucial to learn how to be qualified for pre-settlement loans. Is it possible to get multiple pre-settlement loans?

How Many Pre-Settlement Loans Can I Get?

If you have received a pre-settlement loan from any legal funding company, there’s still a chance to get multiple or another pre-settlement loan. It will depend on the individual personal injury claim. The cases of personal injury may take months or even years to resolve.

That’s why it’s common for clients of legal funding to need an extra advance. This is particularly true if the clients are unemployed or uninsured because of the injuries. No paycheck makes it harder to pay the bills. One or more pre-settlement loans will help.

Two Pre-Settlement loans or even more will help reduce clients’ financial stress. The loans will also let clients’ lawyers get the time they need so that they can negotiate a solid settlement. No limit is set on the pre-settlement loans’ number clients can receive.

Benefits of Getting Multiple Pre-Settlement Loans

Do you need the second pre-settlement loan after the first one? The decision to access the settlement to use for any needs is a personal decision, based on the client’s circumstances. Keep in mind that the funds are yours and you have the right to access the funds early on.

If you don’t need to use the funds, you shouldn’t use pre-settlement funding, so that you can reduce the costs. But if you need the funds, then consider getting the second pre-settlement loan. Doing this is going to give you some benefits.

1. Continue your medical care

Knowing how many Pre-Settlement loans can I get won’t be enough. You should also need to know what to do with the second pre-settlement loan. If you can’t afford to continue the medical care, like paying people to care in the nursing home facility or help at home, get a second loan.

The pre-settlement funding is going to help you provide additional support in doing this. The second pre-settlement funding can be very helpful.

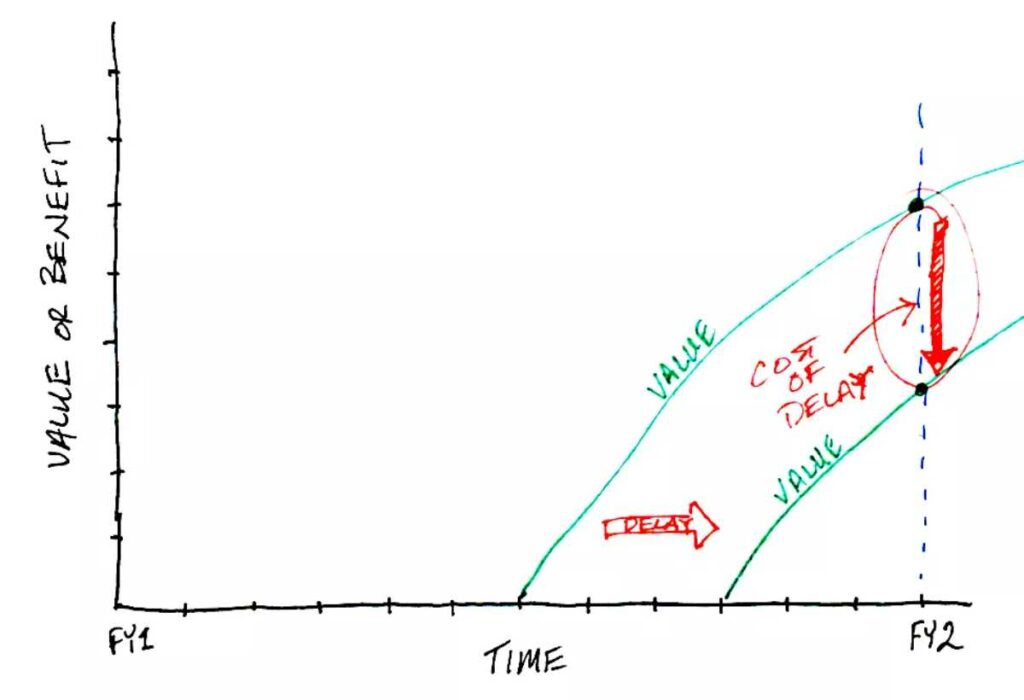

2. Delays will cost you

The legal system may move slowly. As it does, the legal system may cost people dearly. The cost can be very high, especially when it comes to maintaining the quality of life or keeping paying the bills. Additional safe Pre-Settlement loans may help you with this.

3. You need help with an emergency cost

In several situations, you may need much more money very quickly because of some reasons. If there is any emergency, you may want to consider getting a second pre-settlement funding that is going to help you.

How Much Money Clients Can Borrow?

Many factors will play a role in gaining pre-settlement loans clients can claim. If clients are facing personal injury lawsuits that are worth millions of dollars, they may be able to borrow more than clients who claim a dog bite injury and a couple thousand dollars in medical bills.

Any legal funding company will help answer your question about “how many Pre-Settlement loans can I get” and how much can you get from the additional pre-settlement funding. You don’t need to apply the second time if you obtained the first loan from the same legal funding company.

However, you may need to contact the legal funding company to get more insight into Pre-Settlement loan calculators and every single detail about the funding.

How Long The Process Will Take?

Usually, it will only take a few minutes for the legal funding company’s team to provide clients with insights into how much more clients can get. However, some factors may affect the duration of this process. Those factors include:

- The client lawsuit’s status.

- The amount clients already received.

- And the personal injury claim type that the clients are waiting for.

Like the previous pre-settlement loan, clients don’t need to worry about their credit score. They don’t have to provide proof of employment or other financial data.

The payment that will cover the pre-settlement funding cost comes directly from the settlement clients receive when they become payable.

There will be no cost or harm to clients by applying for another pre-settlement funding. Keep in mind that those are not loans. Clients don’t need to pay them back if they lose their incurred or don’t obtain a settlement.

Many things may cause trouble. If you cannot fix them and need help, you may want to apply for a pre-settlement loan and additional pre-settlement loans. How many Pre-Settlement loans can I get? Get some benefits by receiving multiple pre-settlement loans from the same legal funding company.

Also Read:

- List of Fake Loan Companies

- What is a Business Purpose Loans?