What will you think when you hear the words financial abundance? The word abundance is frequently associated with prosperity thinking and the new age law of attraction. For many people, this is a lofty goal they need to achieve.

But for other people, this is just an attitude about money that no one should take seriously. Some other people believe that living in this abundance is something too much to ask. What about you? Are you interested in living abundantly in your financial life?

Understanding Abundance in Financial Life

Definitions for abundance vary depending on who you will talk to. But generally, abundance in financial life means the feeling that you have enough money and you have gratitude accordingly. Many people are surprised to know that abundance is not about having a bunch of money.

Abundance in financial life is like a state of mind, a balance between knowing how much money is considered enough, having enough money, and feeling satisfied with the money you have. For some people, an abundance of wealth means the ability to make ends meet with no worry.

But for some people, this abundance may mean having more than enough so that they can live their dream life. The most important thing about abundance is that you meet all your needs and you are feeling content, not striving for more, boastful, or afraid. Contentment is the key to this feeling.

How To Encourage Financial Abundance?

Everyone today wants to know what they can do to achieve financial comfort and security. Though feng shui tips may comfort you, they won’t give you the abundance and wealth you need. What you really have to do is change your money habits and live much more responsibly.

1. Track all your spending

You need to know where all your money goes and how you may waste most of your money. Always make a note of every expenditure for the whole month. Write down everything you purchase in the supermarket, every latte you buy for lunch, and every tank of gas.

After a month, you’ll be able to see whether there’s any area that takes most of your money. Oftentimes, you don’t realize how some little things can take all your money. For example, two cups of a $5 coffee every week is going to cost over $500 in one year.

Small changes will have a huge impact on your financial stability. For example, you may want to cancel your streaming service if you never used it in the last six months. Or you may want to make your own latte at home. Or, consider visiting the supermarket once a month instead of three times.

2. Spend less than you make

This sounds very simple. But everyone knows that spending money is now very easy. Everything is now automated and you can even connect your bank account to different devices. Note that you can never start saving your money if your expenses always exceed your income.

And if you keep spending money more than you earn, you will get interest costs. This means, you are going to have less money the next month and you will never achieve financial abundance. This is a vicious cycle you need to escape from if you really want to achieve abundance in your financial life.

Try spending less by choosing something that is going to bring you lasting joy. Then, couple it with getting rid of various expenses that will destroy your budget. You are going to achieve inner peace and abundance faster than you know.

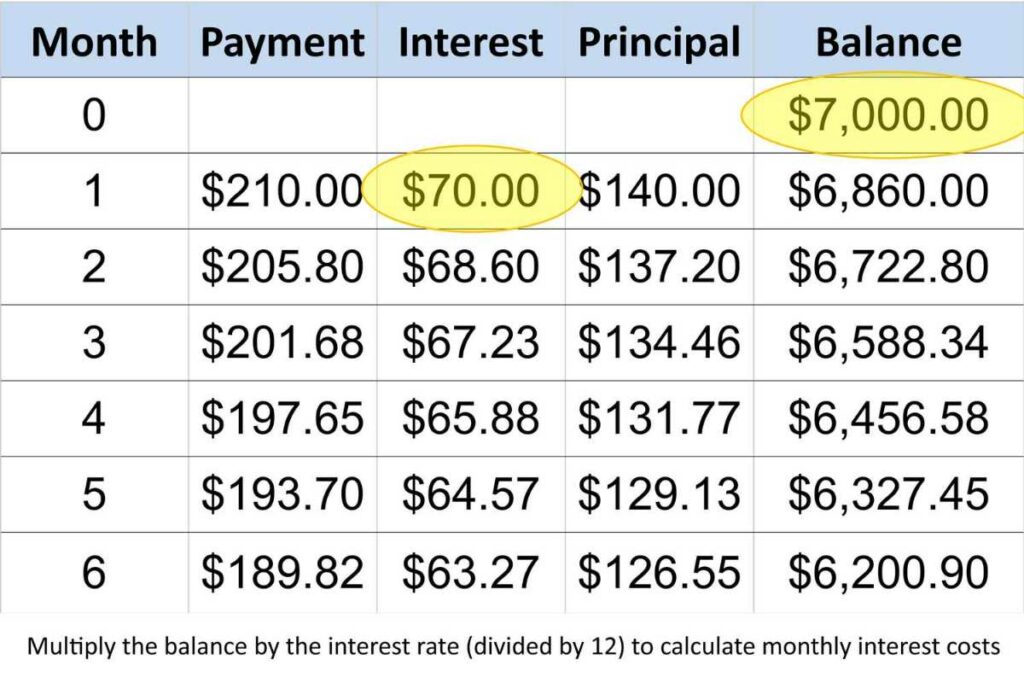

3. Pay off the monthly credit card balances

You can use your credit cards without having to pay the interest. You can do it simply by not charging more than your wallet can afford to pay back in full every month. Pay the full statement balance every month by the due date and you will never have to pay the interest.

Paying less compared to the full balance or even making only the minimum payments is not recommended. Doing so won’t help you achieve financial freedom. The amount of interest is going to exponentially increase and you have to pay them over time.

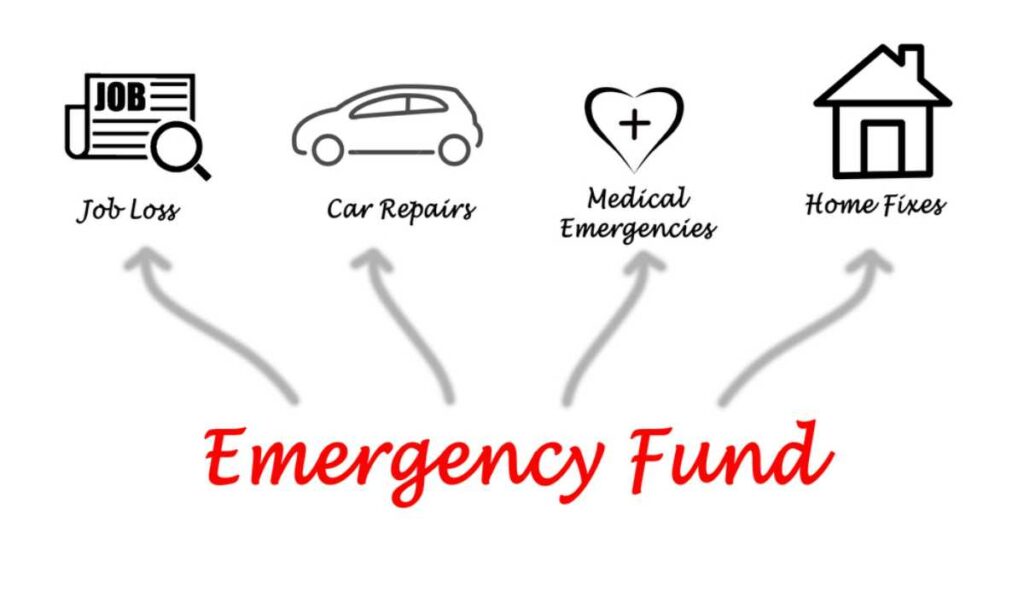

4. Prepare your emergency fund

Your emergency fund is a special fund you shouldn’t use if there’s no emergency. This fund should contain at least 3 to 6 months worth of living expenses. It will serve as a very helpful cushion to fall back when any emergencies arise.

The emergency fund will provide a sense of financial security. But it will also help you stay away from having to borrow money or high-interest credit cards. If you can keep the funds in a high-interest savings account, you will achieve financial abundance more quickly.

You should also know what constitutes emergencies. Don’t use your emergency fund to pay for your vacation. The money should be ready for real emergencies, such as when you lose your job or when you need help in covering unexpected medical bills.

5. Know what you really need and what you want

You will be financially abundant if you know the differences between needs and wants. Needs can vary, depending on who you are. But many people will need a job that will bring them money, a home to live in, transportation to take them to places, and food for all members of the family.

Differentiating wants from your needs will help you achieve abundance in your financial life. If you don’t have extra money for what you want, it is okay. What matters is everyone at home has everything they really need.

Knowing the differences between what you need and want will also help you focus only on the needs instead of wants. This is going to help you save more and buy something you want occasionally in the future. That’s how you can live abundantly while enjoying your happy life.

Adjusting your expectations for any financial situation you’re in is the key to live abundantly. But many people still believe that financial abundance means living the best life with a lot of money. You can live abundantly with whatever you have now while saving for a brighter future.

Also Read:

- What is Financial Considerations in Business?

- How to Get Ahead Financially: A Complete Guide

- Steps to Financial Freedom