Being a mom is not a status, it is a full-time job. Every mom wants to be the best and give the best to their little ones. Unfortunately, many moms are single moms and they need help on how to survive financially as a single mom.

Living as a single parent is harder than raising kids with a partner. As a single mom, a woman needs to raise their kids and be there for their loved ones, while making money at once. Though it is extremely challenging, single moms can survive.

How To Live On Your Own As A Single Mom

Many financing programs are designed for single moms. One of the most famous options is the credit cards dedicated to single parents so they can use them to buy everything they need. Multiple lenders are now offering emergency cash for single mothers.

However, those loan products may also negatively impact the budget of single moms since they need to make on-time repayments. Below are some steps single moms need to consider so that they will be able to survive in their battle.

1. Track and change financial habits

Single moms must attract extra money in their life. If you’re a single mom, then you need to review your spending habits. This is going to help you know where you should start from. Recognizing past financial mistakes will help you create a much better new plan for your now and future.

Always track the way you and your kids spend money. Also, ask yourself what to do to be much more responsible about your financial life. How to survive financially as a single mom? After tracking your financial habits, you may want to open a bank account.

Don’t carry all your cash with you since it will cause you to overspend the cash. Don’t go into debt if you’re not in an emergency. Always live within your means. This is going to help you be financially healthier.

2. Create a budget

If you’re always stressed about money, you are probably financially unorganized. Most single moms are feeling the same because they have no budget. The first thing to do in creating a budget is open all the bills as you receive them. Don’t ignore them or they’ll ruin your future.

Then, you may want to plug the entire accounts you have into a third-party website or app. Many websites and apps will help single moms create budgets and meet their financial goals. With those apps or websites, you can survive as a single mom by paying off debt and saving more money.

3. Move somewhere else

Finding a much more affordable house will help you save a lot and afford more. It is essential to consider moving to another area that offers lower accommodation costs. Or, you may want to move to a smaller house in the same region.

Many single moms survive by moving to the suburbs to save their money. Before moving, you should also check the increasing costs of transportation or travel time, especially if you have to study or work in the city.

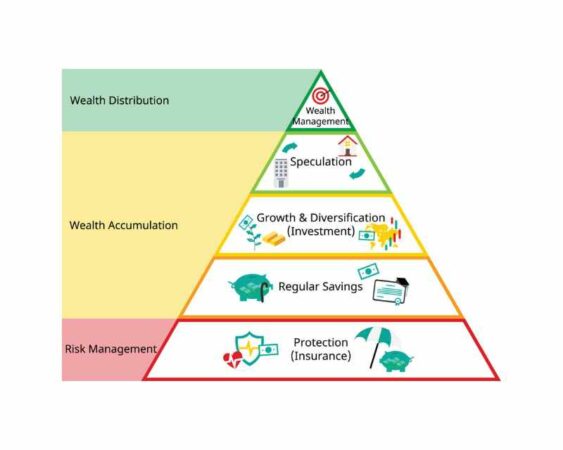

4. Get insurance

Getting insurance is also another answer for how to survive financially as a single mom. Insurance is going to help single moms save money, especially in the long run. A life or health insurance will also prevent potential financial issues if the worst case happens.

Life insurance is going to keep your little ones surviving financially if their mom suddenly passes away. And health insurance is going to help single moms cover the costs of preventive as well as emergency treatment for their kids and themselves.

5. Increase your income

Another answer to how to become financially stable as a single mom is earning more money. There are a bunch of options single moms can do to earn a lot of money. Some of those excellent options don’t even require moms to leave the kids alone at home.

For example, you may want to be a copywriter, proofreader, virtual assistant, or social media manager. Many other single moms also become pet sitters, tutors, bloggers, or even rent their spare space. Pick one that will fit your skills and time.

6. Don’t forget your financial goals

Don’t give up, you can get more motivation and get help to focus if you know the goal ahead. Don’t let grocery bills and rent payments distract you from your financial goals. Set clear long-term and short-term financial goals. This way, you can determine what to do to reach your goals more easily.

How to survive financially as a single mom? Keep in mind that starting small can be better than stagnating. If you have a bold goal, divide it into some small steps. This is going to help you get closer gradually to your final goal.

Also Read:

- Financial Life Planning: Definition, Components, and Strategies

- How to be a Financial Genius: A Ultimate Guide

- Steps to Financial Freedom

7. Get help from the government

If you’re still struggling financially, you can survive by getting help. You shouldn’t fight alone and luckily the government is ready to help. The government and non-profit organizations are providing various programs to support single mothers.

Department of Agriculture, Department of Housing and Urban Development, and Department of Health and Human Services are willing to help you survive financially as a single parent. Charities also offer rental assistance to help families with low incomes. Feel free to get help from any of them.

8. Find affordable childcare

If you have to work to earn money that will support your little ones, don’t leave your kids alone at home. Find affordable child care that will help you care for your kids. Many childcare facilities offer low cost while others are even available for free.

Leaving your little ones in a childcare facility is not a crime. In fact, there will be adults watching for them and keeping them safe while you’re trying to give them a better life.

So, how to survive financially as a single mom and not lose the battle? You’ll never fight alone. Out there, the government will be ready to help. However, it is crucial to start at home by tracking your own financial habits and trying to make more.