Financial minimalism is a beautiful lifestyle choice that is going to center on eliminating physical, emotional, or mental clutter and embracing simplicity. This minimalism in financial life is advocating people to spend less on material items while investing energy, money, and time into experiences.

By becoming a financial minimalist, you will be able to improve your own money situation, especially if you can pay down your debt, invest to build wealth and grow savings while still enjoying your beautiful life. What you can do to adopt this minimalist lifestyle?

Practicing Personal Financial Minimalism Properly

Many ways will guide you to be minimalist in your financial life. Below are only some tips that will help you organize your financial life in a much better way.

1. Always track your spending habits

The best thing to do when you just started practicing minimalism in your financial life is to track your daily life spending. You may need to spend weeks to months recording everything you spent deliberately until it becomes second nature.

By tracking your spending, you’ll see where all your money is going and all the unnecessary purchases you make. Although sometimes this financial minimalism guide feels like too much information, knowing exactly where your money is going will give you power and awareness.

As a result, you will be able to make a much better spending decision. After tracking your money, you need to focus on the biggest money leaks. That’s how you can focus on cutting out many unnecessary expenses while saving more money every month.

2. Cut out any unnecessary expenses

The next practice you must learn is how to cut out all expenses you don’t really need. This is something you can do anytime, not only when you are practicing the minimalism lifestyle in personal finance.

When practicing minimalism and financial freedom, you need to know that you don’t need all material goods to be happy. Those goods will only offer temporary happiness. A lot of expenses and habits will bring no value into your life.

For example, you may want to start carrying your packed lunches to work instead of eating out every day. Do you use your cable TV often? If you realize how little you are using your cable TV, you may want to consider getting rid of it and start enjoying free content online.

3. Make money but don’t spend it

Everyone loves shopping today, especially since it can be done quickly and easily through smartphones. It is time to use your smartphone to earn money instead of spending it. You can earn money online through blogging or Etsy.

Once you realize that earning money online is super fun, you’ll feel more comfortable working from home. Though you have a full-time job, you can still earn more money at home. But don’t spend the money you earn from this side job. Save it and make it useful in the future.

4. Get a savings account

When you start this financial minimalism lifestyle, it is crucial to get a savings account. Then, the first thing you should do before buying new things, going out to dinner, or spending money in different ways is transferring money to your savings account.

This has to be your routine, particularly if you want to grow a lot of money for a brighter future. Minimalism in personal finance is not only about giving up the entire money or not purchasing anything. It is also about deciding what makes it valuable in everyday life.

Even if you decide to start small in transferring money to your savings account, learning how you can be a financial minimalist will change you and give you a better life.

5. Reduce your debt

If one of your financial goals is reducing debt, then living within your means or having less debt will be a practice that will go hand in hand with this minimalism in personal finance. Don’t spend more than the money you make. It will be much easier for you to pay off the debts.

It is because you won’t waste your money constantly on any unnecessary expenses every week or month. If you have credit card debt with high interest, it is essential to eliminate it as soon as you can. The best way to do it is by making more than the minimum monthly payment.

You can also pay off the balance in full every month. This is going to help you avoid fees and interest which can be very high for credit card debts. Or, you may want to switch to a credit card with lower interest so that you can pay off the debt much quicker.

6. Financial minimalism and investment

Investing is not something you can do only when you have a lot of money. Just like anything else, it is much better to invest while you’re still young. For example, you can invest in yourself by working on improving your skills or learning new skills.

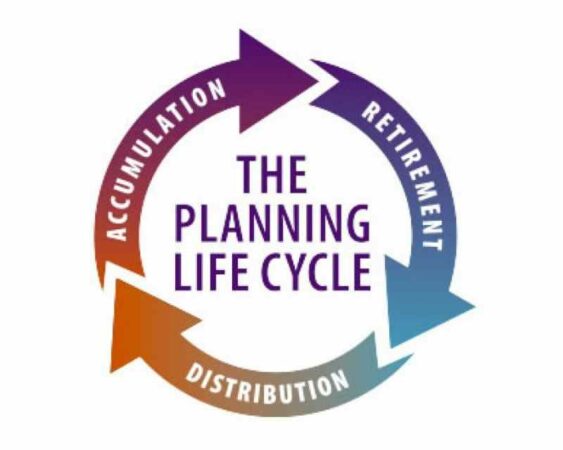

Another investment is minimalistic investing which can contribute to your retirement account. Or, you can invest in low-cost funds so that you can reach any goal sooner. Before investing, you need to be debt-free and you shouldn’t need the money you will invest for the next five to ten years.

Also Read:

- Financial Life Planning: Definition, Components, and Strategies

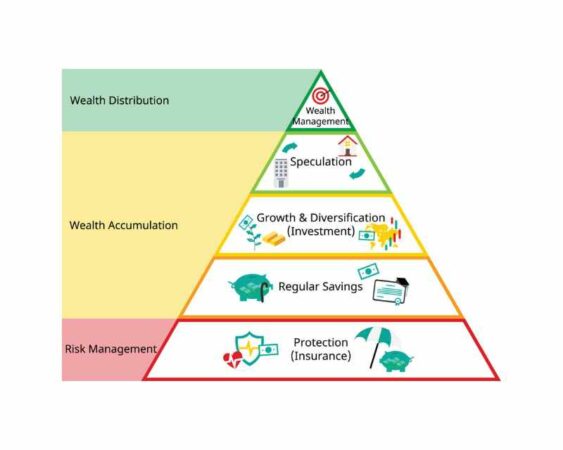

- What is a Financial Planning Pyramid?

- Steps to Financial Freedom

7. Compare prices and negotiate

To live a frugal life, it is also crucial to compare prices and negotiate. This means you need to search online to find a much better deal. Or, you may want to negotiate for a lower price. Comparing prices online will help you find the right store where you can find everything cheaper.

However, you should be aware of the product quality. Some products are cheaper but they have lower quality. If you buy a cheaper product that won’t last long, you’ll spend more to fix it or replace it with a new one which is not something you want as a financial minimalist.

Living a minimalist financial life is going to guide you to a better life. The 7 tips above will bring you to a better future. However, you may have to work harder to start the financial minimalism lifestyle at first.