It may not be easy to be a nurse, even though you get the call to serve in this sector. This profession requires a significant investment of money and time. After getting a nursing license, you will have to learn many things like making financial planning for nurses to face the challenges.

It is crucial to know how to manage your finances effectively. It includes paying off debts, being ready for emergencies, and growing savings. Though it is essential for everyone, it is especially crucial for nurses since your budget plans can be very complicated due to forces beyond your control.

A Guide To Financial Planning For Healthcare Professionals

Nurses around the world are facing unique challenges, especially when they want to start saving. That’s why, nurses around the globe should be financially savvy. Below are some steps that will help nurses plan their financial lives much more effectively.

1. Setting up a budget

Budgeting is always overwhelming, especially for those who are new to budgeting. If you have never done budgeting before, you need to make yourself keep track of the entire regular expenses. Every time you spend your money, it is crucial to write the details down.

Write down how much you spend for subscriptions, utility bills, transportation, groceries, and mortgage or rent. Creating a budget will let you see how much money you have spent and what you have left over after subtracting expenses from income.

If you spend more than you make, then you must cut down on the expenses or decide to make more money. A lot of people figured out that making a budget is a helpful step in financial planning for nurses. It is a valuable exercise that will help them understand where their money goes.

2. Prioritizing the money

After creating a budget, it is essential to set priorities. How to prioritize your budget? Simply contribute every week to your savings account and prepare enough money for emergencies. Or, you may want to dedicate your excess income to pay off any debts.

In budgeting for nurses, it is crucial to know your weekly income. Don’t have this mindset of working extra so that you can save to pay for your dream vacation. It is crucial to track all your expenses and rank what’s important before spending your money.

Saving is truly important, always spend less than you earn and always plan for emergencies. Those steps are going to help you enjoy a better and safer life in the future.

3. Focus on debt payoff or savings?

Savings is essential. But every nurse should also be smart about financial decisions. A lot of nurses figure out that it makes more sense to pay off their debt before they can save money. However, every situation is special, so you need to know how much debt to pay off.

If you have a credit card debt, then you may want to pay 15% to 20% interest for any amount you carry every month. You also need to pay the fees if you don’t pay the monthly minimum. The first priority in your financial planning for nurses should be paying off high-interest debt.

If possible, you can set aside a small amount of money at the same time into the emergency fund. Setting aside USD25 every month will add up very quickly in a few months. This can help you stay away from another credit card.

4. Preparing for emergencies

The emergency fund is the money you need to set aside so that it can help you when unexpected things happen. A lot of unanticipated events may happen, such as automobile or appliance repair. This emergency fund is important since many employers don’t cover time off for some conditions.

Also, emergency funds are essential for a travel nurse who want to take time off in between their assignments. If nurses are planning on getting back to school to get an advanced degree and must cut back on their working hours, emergency funds will help.

Experts suggest nurses have financial planning for medical professionals with 3 to 6 months’ worth of living expenses in their emergency fund. But it is an unrealistic goal. You need to adjust it with your own budget you have created.

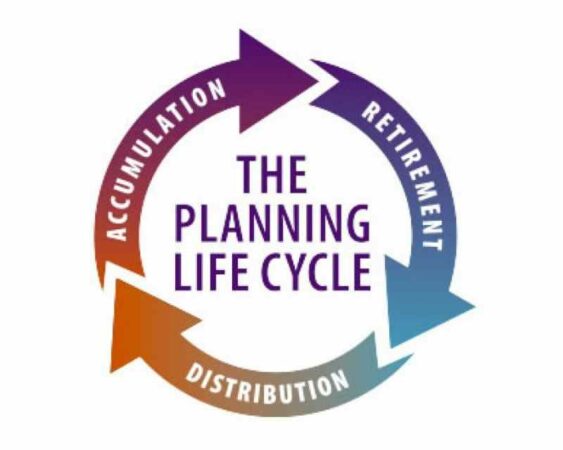

5. Nurses’ retirement planning

Retirement planning is actually important for anyone but it is much more important for nurses, especially if the nurse is a per-diem nurse who won’t get any traditional retirement package. Putting your money away for retirement is not like putting money in your savings account.

Your retirement account is something you will rely on when you don’t earn any income anymore. An individual retirement account is now available at many banks for anyone. This account allows you to deposit your money and it won’t be taxed until the day you withdraw it.

6. Financial planning for nurses: investment for nurse

Investing is nothing like saving. Both financial activities are essential, but their goals are not the same. Should you invest? When you want to invest in something, you’ll have this expectation that the thing you purchase will increase in value.

However, there is no guarantee that it will experience an increase in value. Though you finally decide to invest in conservative assets, investment always involves a level of risk. You can create an enormous amount of money by choosing investments that will gain significant value, such as:

- Purchasing stocks or buying shares of ownership in any public company. it is always better to open a brokerage account instead of purchasing stock on your own. An online broker is going to make recommendations based on your level of risk and investment goals.

- Bonds are fixed-income instruments. Companies and governments issue these instruments to raise money by borrowing money from investors. However, before investing, it is always best to learn advanced nursing financial management.

Financial planning for nurses is essential today since many things have changed due to the pandemic. If you want to prepare your future in a better way, don’t buy anything you want. Save your money and learn every detail about making financial planning on this page.

Also Read:

- Financial Planning for High Net Worth Individuals

- Fundamentals of Financial Planning