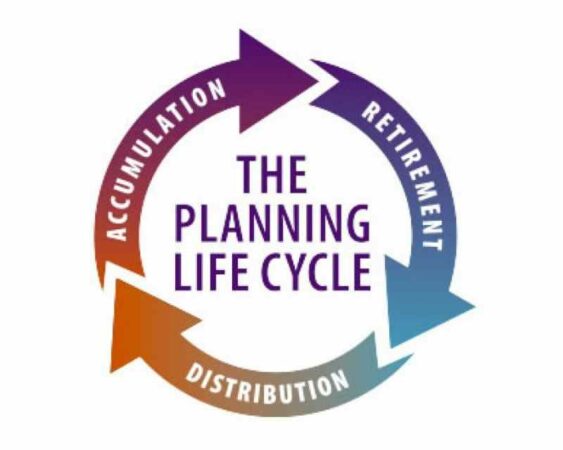

Experts in research, client advisory, and tax have analyzed 3 different phases and some fundamentals of financial planning. The three phases are planning, implementing, and maintaining. Each phase is going to help empower thoughtful management of your financial health.

It is essential to know the right way to navigate your financial future. Then, you can take control of your own finances through financial planning fundamentals. First of all, it will be crucial to learn more about the three phases.

3 Phases In The Basic Of Financial Planning

Each phase will require you to learn some different steps. Each step is essential if you want to keep your finances stable. Below are the three phases to learn.

1. Planning

The first phase of the fundamentals of financial planning contains 3 different steps to take. Those steps are building a budget, defining the right strategy based on your financial goals, and planning for your retirement.

Building a budget

This first step is going to give you a solid foundation to create a stronger financial plan. To build your budget, it is essential to understand the current situation. Compare how you earn your money and where you spend the money.

You will be able to understand if you have flexibility with your budget if you know the difference between variable and fixed costs.

- Variable cost is any expense that’s easily modified or flexible, such as shopping, travel and leisure, health and fitness, food and dining, and so on.

- Fixed cost is any expense that won’t change regularly or cannot be adjusted easily, such as student loans, utilities, insurance, rent, and so on.

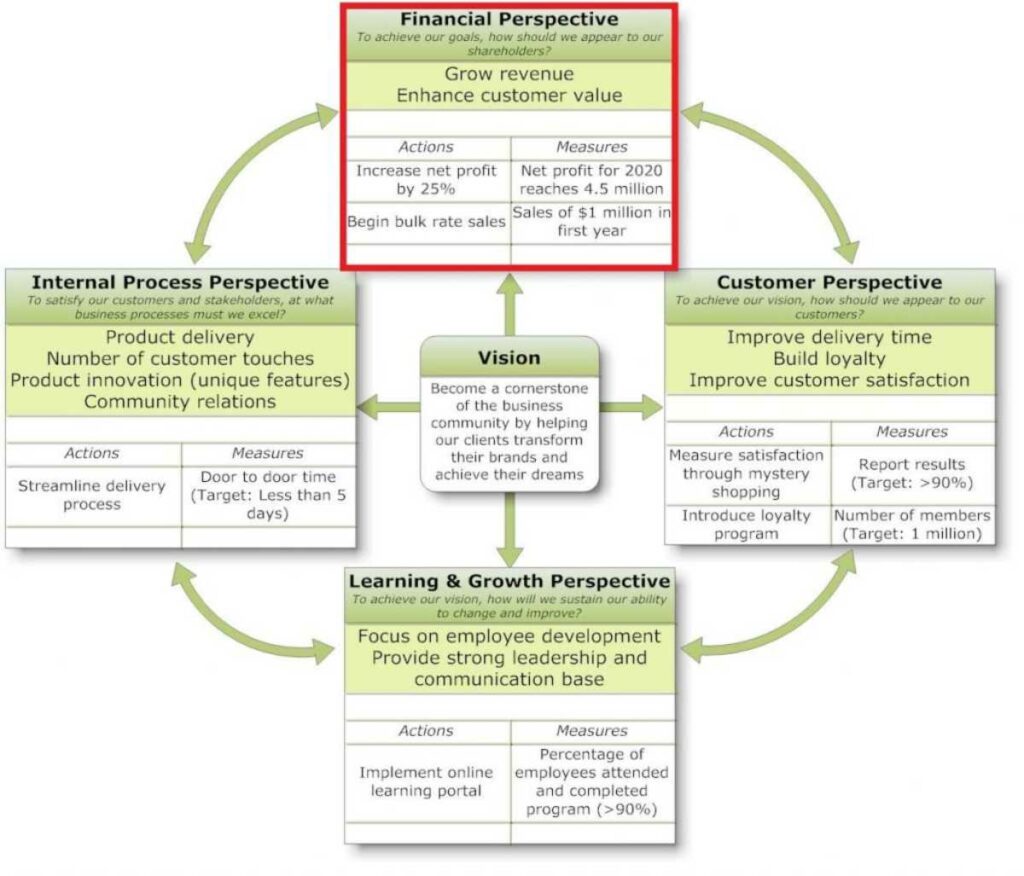

Defining a strategy based on financial goals

After setting a budget, the next of fundamentals of finance is to begin forming your financial goals. Then, you will have to make a realistic plan to achieve your financial goals. As you start the process, you need to ask yourself what experiences and things are important to you.

Do you want to buy a home, travel, or focus on higher education? What’s the timeline you will need to achieve your financial goal? Short-term goals should be achieved within 1 to 3 years. Intermediate-term goals will need 4 to 7 years to achieve.

And long-term goals will require more than 7 years to achieve. Over time, it is crucial to reassess your financial goals. Life may change your goals for you. If it does, then you need to recognize the right time for a shift in your priority.

Planning for retirement

By knowing what you want in your life, you will be able to find the right tools for retirement that will empower you to save for a much better future. Some common tools you may want to consider are the traditional individual retirement account (IRA), Roth IRA, as well as 401(k).

- A traditional individual retirement account is going to let you contribute to your retirement now for an immediate tax deduction for tax-deferred growth.

- Roth IRA is going to let you pay taxes on the contribution now for tax-free growth.

- 401(k) can be treated as an IRA or Roth IRA, depending on what’s offered by your employer and your election. You need to check if the employer matches the contributions. If your employer matches, then you need to try to take full advantage.

2. Implementing fundamentals of financial planning

The second phase is the implementation. Implementing your financial plan may feel scary. It is like climbing a mountain. Different paths are going to take you to the top but each path comes with its own challenges and ups and downs. But you still have to climb and reach the peak.

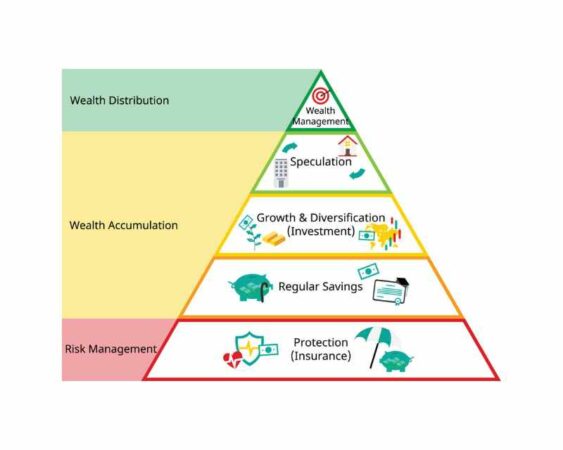

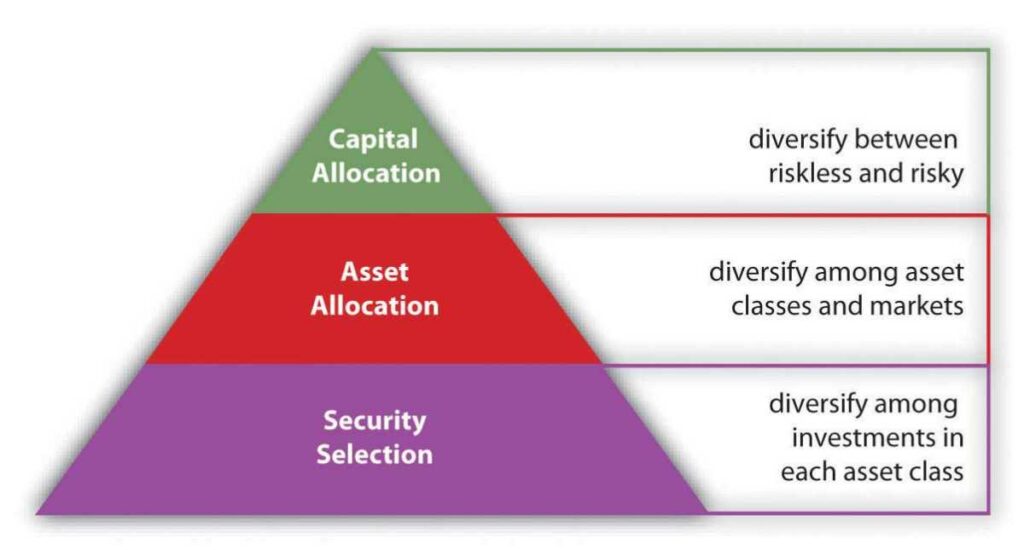

Risk understanding and diversifying your asset

By understanding risks, you will be able to navigate the right path in achieving your financial goals set in the previous phase. The largest risk you may face as an individual investor is falling short of your goals.

One of the principles of financial planning you should know is managing risk properly. Manage your risk through investing across your asset classes.

You can change your portfolio risk by adjusting the exposures and weights to different securities and asset classes you hold, also known as diversification.

Always remember that portfolio allocation must match your goals’ time horizon. The money you will need for your short-term goals should never be used in volatile investments.

Knowing your costs

The next fundamentals of financial planning is knowing that you can see costs as a weight. You are free to carry the weight with you along the way to the peak. Over time, some small fees can even slow you down. It is essential to look at how much time you spend on fees.

You should also try to mitigate those fees when possible. Just like budgeting, you need to know what costs are and where those costs come from. That’s how you can avoid any cost that will weigh you down.

Some types of costs you may want to know are manager fees, wire fees, transaction fees, and custody fees.

Also Read:

- Financial Life Planning: Definition, Components, and Strategies

- Financial Abundance: What is it and How to Get it

- How to be a Financial Genius: A Ultimate Guide

3. Maintaining

The third phase in the fundamentals of financial management is maintaining your relationships, health, and valued possessions so that your beautiful life can run smoothly. You should also maintain your finances as well.

Manage portfolio

You must follow the course you have set and focus on the path you have chosen. This means don’t let any swings in the market and trending recommendations in social media drive you to make daily decisions.

Charitable giving

If you want to make an impact, then consider charitable planning. you can even deduct your donations on the tax return simply by itemizing everything. No matter what your goal is, there are many tools you can use to align this charitable planning with whatever you want.

Navigate your capital gain exposure

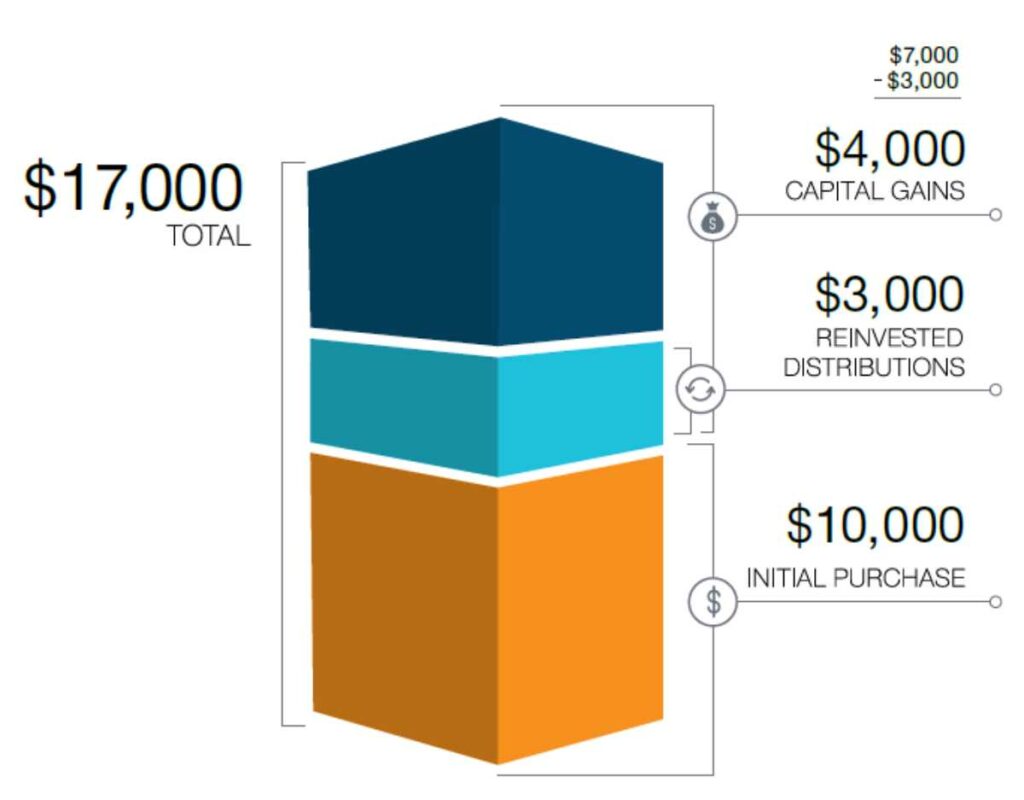

Realizing your capital losses and gains generated from the portfolio you own is essential. A capital loss or gain is the difference between the purchase price or tax cost basis and the price when you sell your asset.

The three fundamentals of financial planning are all crucial. Every step in the three phases will let you know what to do to maintain and even grow your assets.