Kahnattorneys.com – Like a map taking you to your destination, financial life planning will take you to your financial goals. Making financial planning can be done in two different ways: with a professional or on your own. A financial plan is like a comprehensive picture of everything related to your finances.

It shows you your current financial condition, your future financial goals, and all the strategies you will need to achieve your financial goals. Proper financial planning must include some details like insurance, investments, debt, savings, cash flows, and other elements of your own financial life.

Understanding Financial Planning Before Making One

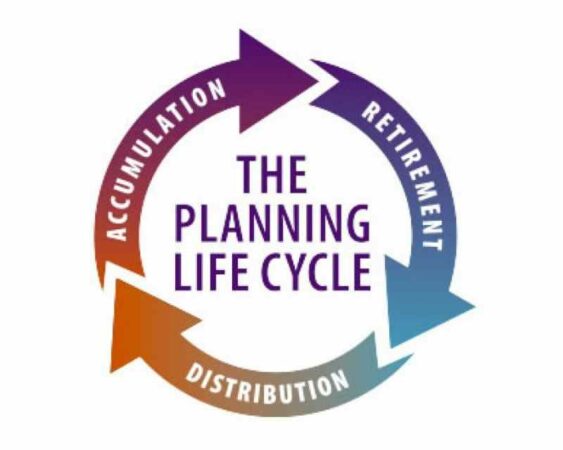

You’ve learned about financial plans. Now, you need to know what financial planning is. This planning is an ongoing process. The process will look at your financial situation so that you can create the right strategies and achieve your long-term and short-term financial goals.

The financial planning life cycle will help reduce your stress related to money, support everything you need at the moment, and help you create a nest egg for your financial goals such as your retirement. It is crucial to create your own financial plan.

Making your own financial plan will let you make the most of all your assets. It will also give you the confidence you’ll need to face all bumps during your journey to your financial goals. If you don’t want to do financial planning with a professional, learn how to make it on your own.

Steps in Creating Financial Life Planning

Every single step below is going to lead you to your financial goals. All steps together will help you build solid financial planning.

1. Set the financial goals first

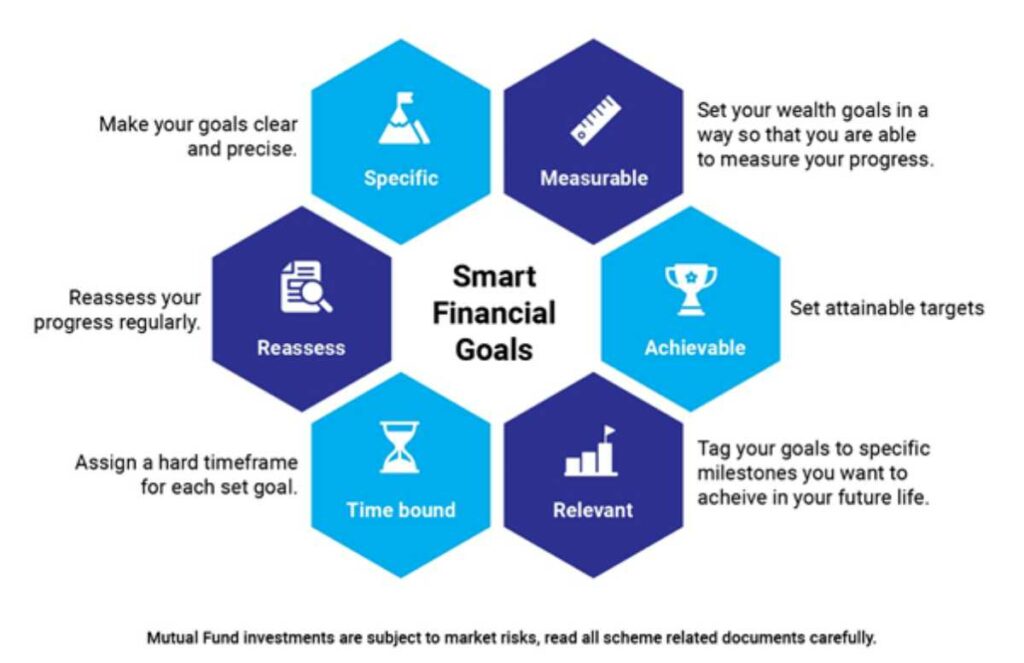

No plan can be made if there’s no goal to achieve. A proper financial plan will be guided by financial goals. What do you want to do with your money in the future? Do you want to buy your dream home or retire earlier? This goal is going to make your savings more intentional.

Your goal can be long-term or short-term. What do you want your life to be in 5 years? What do you want it to be in 10 years and 20 years? Do you want to get a house or a car? Do you want to be free from all debts? Will you have kids in your life? The answers will affect your life’s financial planning.

Having concrete and solid goals will make it much easier to identify your next steps. Your goals will also give you a guiding light when you work to achieve them.

2. Track the money

It is crucial to know how much money you actually earn and how much money you spend. Get an accurate picture to create your financial plan. The accurate picture will also help you reveal the best ways to direct your money to your savings or to pay off your debts.

By seeing how you used to spend your money, you will be able to develop your immediate-term, long-term, and medium-term plans. For example, you may want to use the 50/30/20 budget principles. Use 50% of the take-home pay to buy what you need like recurring payments, utilities, housing, and so on.

Then, use 30% of it towards something you want, like entertainment, clothing, and dining out. Finally, use 20% of it for debt repayment and savings. The next guide for solid financial life planning is reducing high-interest debt or credit cards while planning for your retirement.

3. Set aside your emergency funds

The basis of all financial plans is setting aside your money for your emergency expenses. To do so, you can start small, like USD500 to cover small repairs and emergencies. This way, unexpected bills won’t run up your credit card debt.

Then, the next goal should be USD1,000 and then continue with one month’s basic living expenses. Grow the money you set aside for your emergency funds so that you can save more for the future. Another strategy in lifestyle financial planning is building credit.

It is a brilliant way to shockproof the budget you have built. Good credits will provide options when you are in need, such as the ability to get a car loan or a decent rate. It will also boost the budget simply by getting you much cheaper rates on insurance.

4. Tackle debt with high interest

All financial plans need this crucial step: pay down debts with high interest like rent-to-own payments, title loans, payday loans, and credit card balances. Interest rates on those debts may be too high and make you repay them two to three times what you borrowed.

If it is hard for you to make solid financial life planning because of the high-interest debt that makes you struggle, a debt management plan or debt consolidation loan may help. It will wrap some expenses into a monthly bill with a much lower interest rate.

5. Plan your retirement now

Retirement may not be in the early stages of financial planning. But you may want to think about your retirement immediately. Any financial advisor will ask you about ownership of an employer-sponsored retirement plan like the 401(k).

The 401(k) contributions may decrease your today’s take-home pay. However, you need to consider putting in enough money so that you can get the full amount of money in your retirement. Many financial advisors will suggest that you expand your contributions generally towards the limit of the IRS.

An individual retirement arrangement or IRA is another savings vehicle you may need to consider for your retirement planning. It is an investment account that’s advantaged by the tax. It will build your retirement savings up to USD 6,500 a year.

6. Build your goals by investing

Investing is only for those who have established in their family and career life. It isn’t true. Investing can be very simple, as simple as putting your money in the 401(k) program. It is very easy to do since you only have to open a brokerage account.

However, you need to learn about risks and returns before joining any investment program. And make sure you use the money you won’t need for the next 5 to 10 years to invest in something.

Financial life planning is going to lead you to your financial goals if only you know how to build solid planning. Learn the steps above and you’ll be able to build your financial planning on your own.

Also Read:

- Stages of Financial Life Cycle

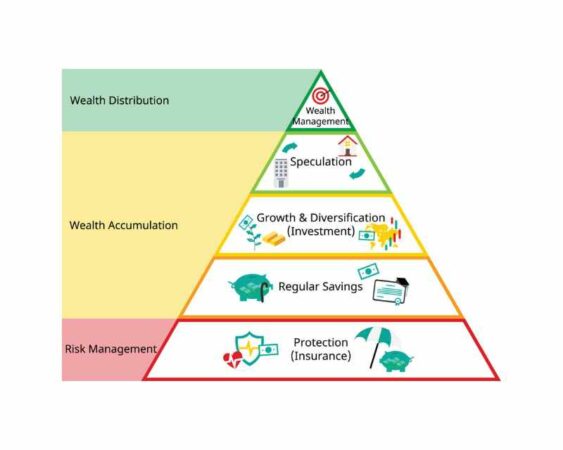

- What is a Financial Planning Pyramid?

- What is Financial Considerations in Business?